CANADIAN ASSOCIATION OF SLAVISTS

SECRETARY-TREASURER’S REPORT

2006

Financial outlook

The financial situation of CAS remains stable in the sense that we continue to receive a fixed $5,910 grant from SSHRC to subsidize travel to the Congress of the Humanities and Social Sciences (CAS Conference.) With interest rates remaining low, the $40,000 CAS fund invested in GICs generates small amounts: $875 during the 2005 fiscal year. The $5 surcharge on CAS membership dues implemented in 2002 amounted to about $650 this year. With this income level we can satisfy requests for travel subsidies at about 50% of the requested amount, for a total of about $6,400 in 2005/06. This leaves slightly over $1000, which is not sufficient for other recurrent expenses, the most significant of which is the cost of membership in CFHSS, $1,909 per year currently.

In the past, the net revenue from the Conference was sufficient to cover the deficit. However, the last two conferences, in Winnipeg and London, did not bring the anticipated income and barely broke even. If this trend will continue, we may be in a deficit position. Because of some savings in the operating account from high interest rate years, we will be able to maintain the present spending model for a couple of years. In the long run, this situation is unsustainable.

CAS Fund and charitable status matters

During this year we re-submitted Registered Charity Information Returns to CRA for fiscal years from 1998-99 to 2004-05. We also re-applied to Canada Customs and Revenue Agency (CRA) to restore the charitable status of the CAS Fund. The original Constitution of the Fund was examined by CRA and ruled incompatible with the charitable status. This is due to references in the Constitution to direct financial support of Canadian Slavonic Papers, which is not a registered charity. Second version of the CAS Fund Constitution, currently under review by CRA, emphasizes educational objectives of the Fund and mentions CSP in the educational context only. The implication is that the Fund cannot transfer money directly to CSP for an unrestricted use, but can pay, for example, CSP’s bills, each time justifying that the expense is for educational purposes. Printing cost of the journal, for example, is such an expense. These intricacies are largely “academic” since the present income of the CAS fund is too small to support activities beyond graduate student travel to the conference and some students’ prizes. Nevertheless, restoring the charitable status of our Fund gives us an opportunity to start a fundraising campaign and issue tax receipts as do Funds of many professional organizations similar to CAS.

One simple fundraising mechanism used by many organizations collecting membership dues is to include a line item “voluntary contribution” on the membership fee invoice. I attached a sample that may be introduced once the charitable status of the CAS Fund is restored.

Current finances

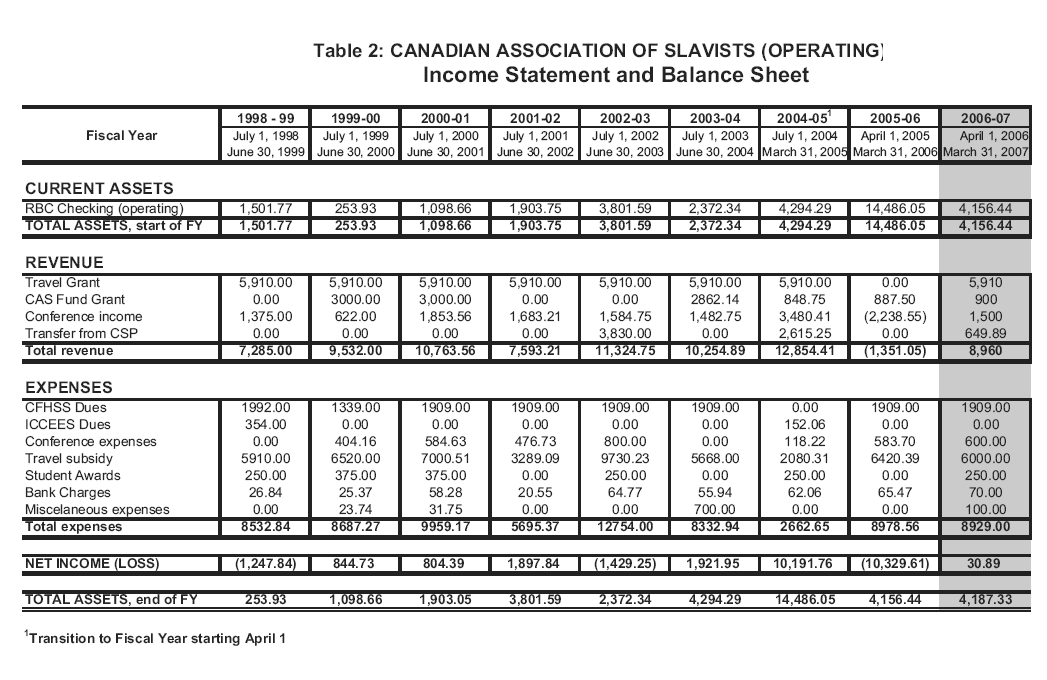

The 2005/06 fiscal year that ended March 31, 2006 completed the transition to reporting periods that start on April 1. In the new 2006/07 fiscal year all income and all disbursements related to the same conference will be reported within the same fiscal year (this was not the case in the past with July 1-based years when conference-related expenses and income belonged to different reporting periods). In addition, fiscal years of CSP, CAS Fund, and of the Association are now synchronized. Income statements of the CAS Fund and of CAS are summarized below for 2005-06 fiscal year, with projections for 2006-07.

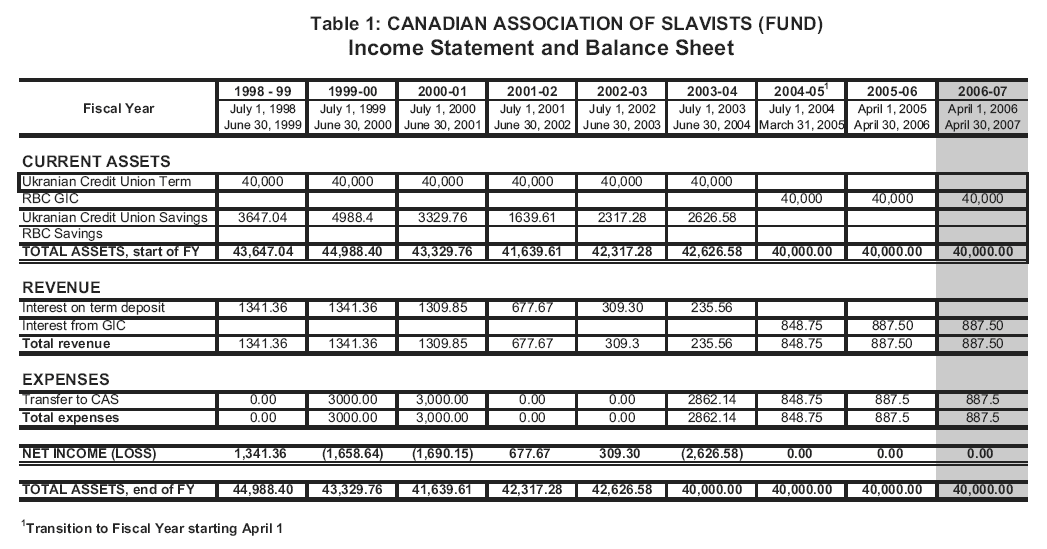

CAS Fund

The following Table summarizes the status of the CAS Fund during the past two years, when the Fund was transferred from the Ukrainian Credit Union to the Royal Bank. The interest earnings of the Fund in 2006-07 are assumed to be the same as in 2005-06. The GICs will mature in March 2007 and will be reinvested at a hopefully higher interest rate. All interest earnings of the Fund are transferred to CAS to subsidize travel of graduate students to the conference.

CAS

The 2005-06 Income Statement and Balance Sheet in Table 2 includes a significant loss in the line “Conference Income” that in combination with the income in 2004-05 gives a positive balance of $3,480.41 – $2,238.55 = $1,241.86. This is because expenses for the Winnipeg conference were submitted almost a year later and had to be recorded together with income from the London conference. The combined expenses from both conferences (that were submitted in their respective fiscal years) are $118.22 + $583.47 = $701.92. Therefore, the net earnings of both conferences are $1,241.86 - $701.92 = $539.94. This very low compared to historic earnings in previous years. The projected conference income for 2006-07 is taken in line with historic levels. Note also that the transfer of $649.89 from CSP has taken place in April and is recorded as projected income for 2006-07 in Table 2.

The projected expenditures for 2006-06 are practically balanced, leaving about $4,000 in the operating account in the end of the fiscal year. The current account balance on May 4, 2006 is $10,711.33. Financial statements for the CAS Fund and CAS since 1998 are also attached.