Canada-China Trade: Q1 2023

Karel Brandenbarg - 29 June 2023

In the first quarter of 2023, Canadian exports to China rose while imports from China fell. This is a continuation of trends observed in Q4 of 2022. Overall, Canada’s trade deficit with China decreased in Q1 due to significant growth in exports across several key industries including agriculture and natural resources, and a decrease in overall imports from China.[1]

The following data is gathered from Statistics Canada for goods (merchandise) trade with China, presented on an unadjusted customs basis in Canadian dollars (CAD). The relevant HS 4-digit identification code is used to identify product groups. All values are in Canadian dollars (CAD).[2]

Canada-China Trade: Q1 2023

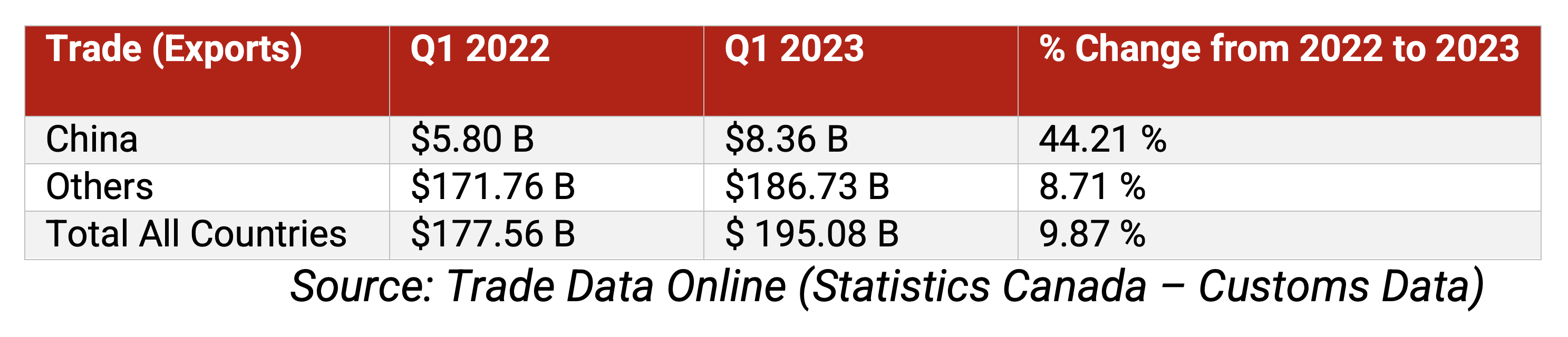

Exports:

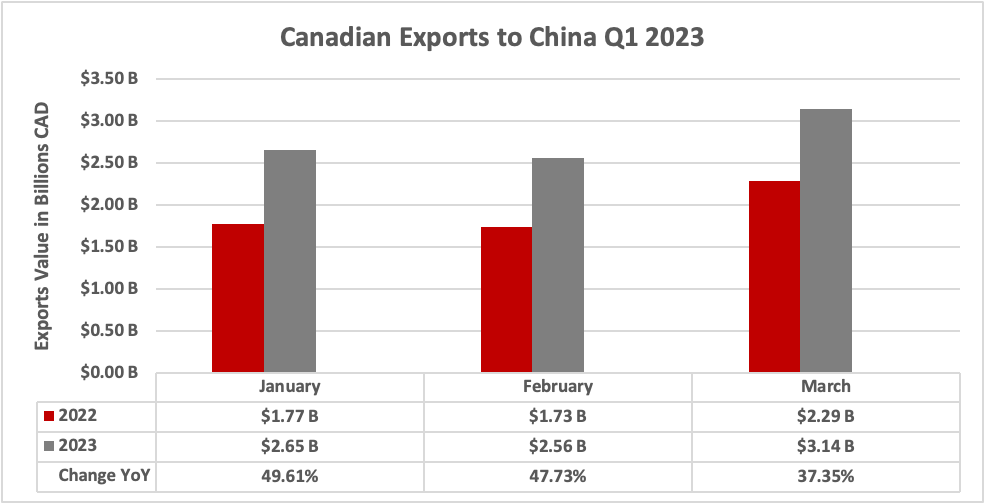

Exports to China stood out among Canada’s overall exports, with a growth rate of 44.21% year over year (YoY) and a total value of $8.36 billion, which is over four times Canada’s overall YoY growth rate of 9.87%. As seen in the graph below, January was the strongest month for growth (49.61%) just edging out February (47.73%). However, March had the largest total value of exports at $3.14 billion CAD. The consistent growth in exports can largely be explained by the reopening of the Chinese domestic economy after Zero-COVID and increased demand driven by the Lunar New Year holiday.

Source: Trade Data Online (Statistics Canada – Customs Data)

The top export to China in Q1 2023 was Canola, with a total value of $1.27 billion and an astonishing growth rate of 331.61% YoY. Coal was the second largest export product with a total value of $879.61 million, however this was 13.85% less than in Q1 2022. Chemical Woodpulp (Soda or Sulphate) was the third largest export product with a total value of $631.62 million (26.49% YoY). Rounding out the top five were two metal ores and their concentrates, Iron ($559.67 million, 65.12% YoY) and Copper ($370.91 million, 27.16% YoY).

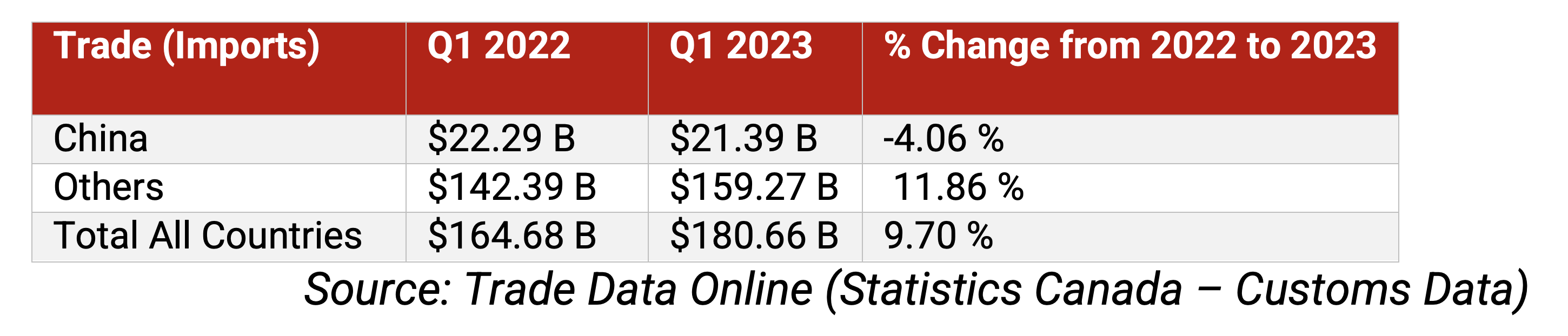

Imports:

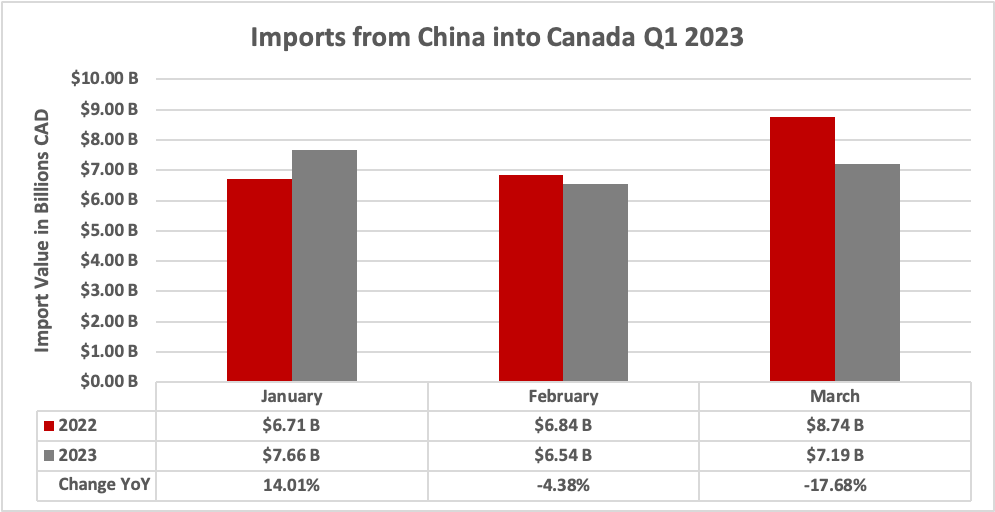

Imports from China contracted in Q1 2023, with a negative growth rate of -4.06% YoY and total value of $21.39 billion. This was an outlier among Canada’s overall imports, which grew 9.7% YoY. January did in fact see positive growth of 14.01% and the highest total value of the quarter at $7.66 billion, however, YoY growth dropped off precipitously in the following months. One explanation for this significant decline is decreasing consumer confidence in Canada and the tightening of belts, especially for many non-essential products coming from China.

Source: Trade Data Online (Statistics Canada – Customs Data)

In line with past trends, the top import products from China in Q1 2023 were Cellphones at a total value of $2.16 billion, with modest growth of 10.78% YoY. The second-ranked product was Automatic Data Processing Machines which had a total value of $1.48 billion and saw a contraction of -24.82% YoY. Water Heaters ($1.08 billion), in third place, were a newcomer to the top five with an astronomical growth rate of 762.76% YoY. Motor Vehicle Parts ($545.79 million, 14.22% YoY) and Furniture ($408.11 million, -10.61 YoY) rounded out the top five.

Canada-China Trade: Last 24 months

Source: Trade Data Online (Statistics Canada – Customs Data)

This macro view illustrates the positive trend of both exports and imports. However, Canada’s trade deficit (exports-imports), represented by the blue line, has decreased over the past six months as the gap in total value between imports and exports has shrunk. The trade deficit is now on par with what it was in May 2021, returning from its lowest point in August 2022. As seen in the stability of the lines, exports have broadly been more stable than imports over the last 24 months.

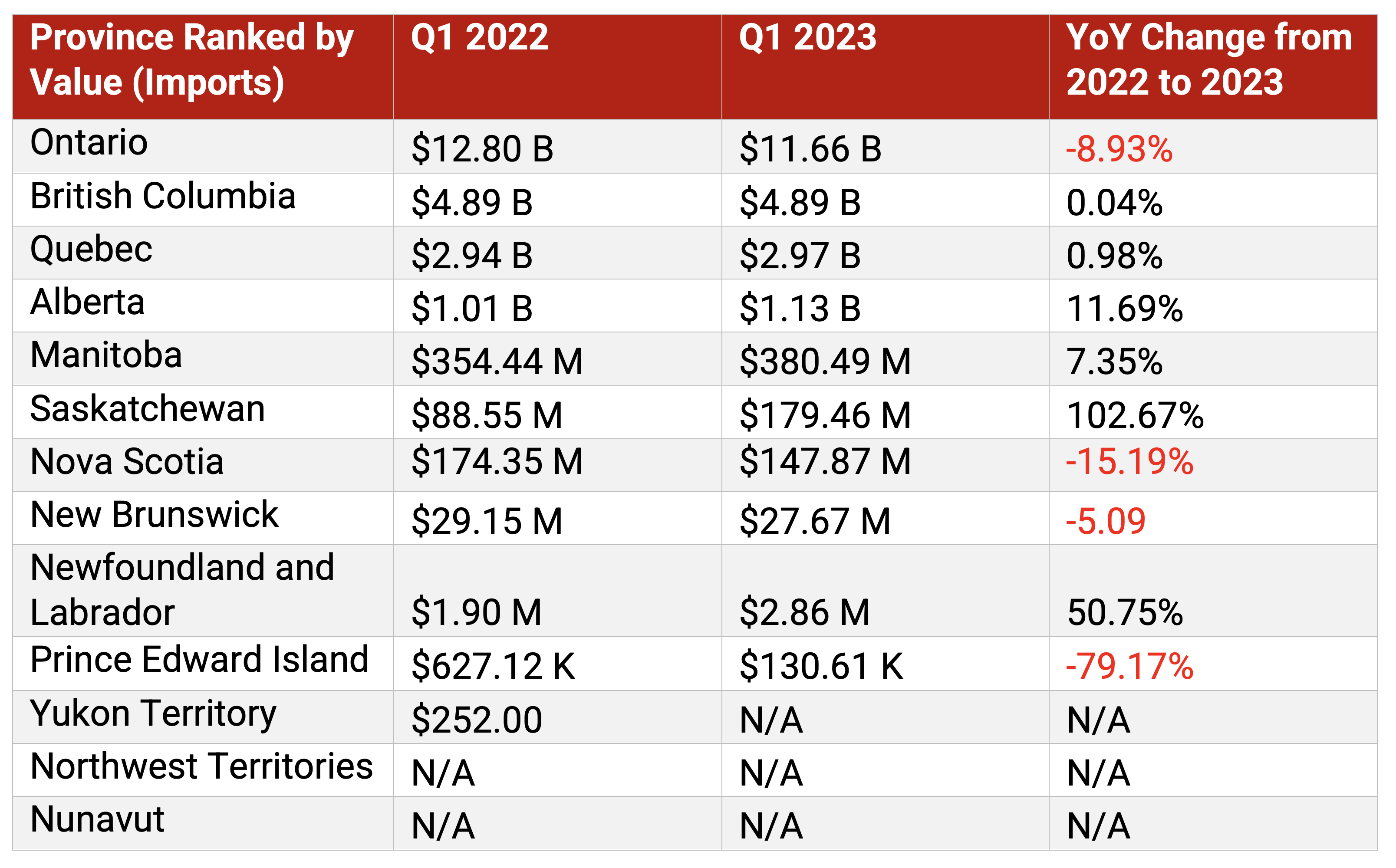

Q1 2023 Canada-China Trade: By Province/Territory

Notation as follows: Billion (B), Million (M), Thousands (K)

Source: Trade Data Online (Statistics Canada – Customs Data)

The provincial data in many ways mirrors the change in fortunes of exports and imports. The resource and land rich provinces in western Canada which typically produce the majority of exports to China saw a large increase in export growth. Whereas the heavily populated provinces in central Canada where most Chinese imports end up saw a marginal reduction in Chinese imports. Ontario, home to over a quarter of Canadians, saw an 8.93% YoY contraction in imports from China, which, given its size, also pushed overall national imports into contraction. In contrast, the prairies saw massive export growth due to increased agriculture demand, with Manitoba seeing a 324.26% increase in exports. Regarding both exports and imports, Saskatchewan saw massive growth with 107.22% and 102.67%, respectively.

Trends & Topics

Turning Trade Tables: A Shift in Post-Pandemic Trade

After the lifting of Zero-COVID restrictions in Q3 2022, the first quarter of 2023 witnessed a continued easing of restrictions and a return to pre-pandemic normalcy. Accordingly, there was an uptick in domestic consumption and with it an increase in Canadian agricultural exports. With the Lunar New Year celebration in late January and early February, consumption patterns were even higher during China’s largest holiday which saw hundreds of millions of people travelling to enjoy festivities and food with family. The full reopening of China after the pandemic was also a boon to its growth, with GDP increasing by 4.5% in Q1, surpassing the World Bank’s growth estimate of 4.3%, and conforming to the Chinese government’s goal of “around 5%”. With increased confidence domestic consumption and production increased, causing a subsequent increase in the demand for Canadian agricultural exports, specifically, Canadian pork, wheat, and Canola.

A major winner of China’s reopening has been Canada’s Canola exports, which have grown at a tremendous pace since Q4, increasing 331.61% YoY. Part of this increase is due to delayed downstream effects of the lifting of trade barriers in May 2022, which resumed Canola exports to China. However, Canada has already exported almost half of the total value of exports in 2018 (accounting for inflation) in just Q1 2023. In combination with increased demand and reduced global supply of Canola due to the Ukraine War, Canadian Canola has enjoyed a massive comeback in the last 6 months after years of turbulence. However, the fear of Chinese trade barriers has not fully gone away given the ongoing diplomatic tensions.

In Canada, the first quarter of 2023 was marked by pessimism as its economy remains fragile. Interest rate hikes to control inflation and generally negative economic forecasts have resulted in decreased consumer confidence and spending in Canada over Q1 2023. One consequence is a reduction in the purchase of non-essential consumer goods as Canadians tighten their belts, which negatively impacts the demand for many Chinese goods. Additionally, when comparing imports across years, it is important to note the impact of the pandemic in Canada. During the pandemic, roughly 30-40% of Canadians worked from home, requiring many to buy electronics to enable or improve their capacity to work from home. As a result, demand for Chinese electronic goods and accessories was temporarily inflated, which boosted imports. With more and more workers returning to the office, demand for such products has dropped and imported inventories have become overloaded and overstocked.

Finally, as Chinese labour costs rise and its economy matures, it has and will continue to become a less prominent source of the cheap consumer goods. As such, certain imports may begin to shift to other countries such as Bangladesh, India and Vietnam. In recent years, Canadian imports from these countries have risen as they increasingly become the new bases for non-value-added products due to their cheap unskilled labour. Even Mexican labour is now cheaper than Chinese labour, and due to its position in the USMCA free trade zone, this has caused even Chinese companies to shift production there. A decrease in Chinese imports might suggest wider trends, yet it's crucial not to over-interpret a single quarter's data, particularly when the decline is just 4%. It remains uncertain whether this particular quarter signifies an upcoming trend or is simply an anomaly.

The Balloon Saga: How a High-Flying Balloon Heightened Canada-China Tensions

One could be forgiven for thinking Q4 2022 would be the lowest point in Canada-China diplomatic relations for years to come, however, relations further chilled over the start of 2023. One of the main events to have potentially long-lasting impacts on Canada-China relations was the now infamous “Spy Balloon Saga”. On Monday, January 30th a Chinese balloon crossed into Canadian airspace from Alaska before returning to American airspace the next day, where it hovered over a military installation in Montana, prompting the suspicion that it was a surveillance balloon. The balloon was subsequently shot down on Saturday, February 4th by the US Air Force off the coast of North Carolina.

Over the next week, 3 more flying objects were shot down in North American airspace, including a balloon over Yukon. However, the nature of these other objects is not fully known both in terms of what they were (balloons or other flying objects), and where they were from (as only the first balloon was identified as being from China). There is some evidence that at least one of the objects shot down might have been a $12 balloon from a balloon hubby club. The increase in the number of objects detected may be due to radar adjustments to pick up smaller objects. Unidentified objects are rather common but rarely reported on. Still, the attention to these objects reflects the depth of political tension with China in response to these balloons.

At a base level, this event did little to help already deteriorating opinions of China in Canada and had substantial effects on diplomatic efforts by both Canada and the United States. Due to these incidents, US Secretary of State Anthony Blinken cancelled a planned trip to China with President Biden calling Xi a “dictator” who was kept in the dark and “embarrassed” by the whole event. For his own part, Trudeau was criticized by opposition parties for what they saw as a weak reaction to the incursions and a soft stance on China. This event put NORAD and China on the top of the agenda list when Biden visited Canada later in March. Thus, the event may be interpreted as having strong negative effects on Canada-China relations and pushing Canada into an even tighter relationship with the US.

Aside from the obvious negative impact on diplomatic relations, this incident contributed to more concerns and barriers to investment and cooperation in research. Not only was Canada already pulling back on its research collaborations with Chinese institutions and individuals with connections to the Chinese military, but this event further prompted greater concerns over national security. Shortly after the balloon saga, it was announced that Ottawa would end all research funding possibly connected with Chinese military and state security institutions and urged universities and provinces to take similar steps. Inevitably, these restrictions will make any research collaboration more difficult as state investment in Chinese companies and institutions are widespread. Therefore, the incident of the Chinese balloon serves as a stark reminder of the delicate balance between international cooperation and national security, with its ramifications extending beyond diplomatic tensions to impede research collaborations between Canada and China, thereby reshaping the landscape of international relations and scientific advancements.

No Stone Unturned: Chinese Election Interference Allegations Increased Scrutiny

Our next story, still unfolding since its start in early 2023, is shaping how Canada and China engage each other and Canadian public sentiment on China. Presently we focus on developments which occurred during Q1 2023 but its further developments will feature again in the Q2 2023 update.

Early reporting on concerns over potential interference by foreign actors in recent Canadian elections can be traced back to May 2022 when CSIS reported in its 2021 annual report that the threat of election interference “increased in scale, scope and complexity”. However, in these early reports, China wasn’t a specific focus. It wasn't until November 3rd, 2022 that CSIS director general of intelligence assessments Adam Fisher stated that China was the “foremost aggressor” when it came to election interference in Canada before the House of Commons committee on foreign interference in elections. Subsequently, in the last months of 2022, conflicting reporting emerged on what exactly the government and specifically Trudeau knew about alleged Chinese election interference. The RCMP also announced it was investigating broad foreign interference by China. However, it wasn't until 2023 that the story became widespread in public discourse.

In mid-February 2023 the Globe and Mail reported on top secret classified CSIS documents indicating that China had employed a “sophisticated” strategy to influence and disrupt Canadian elections in 2021 with the goal of seeing a return of a Liberal minority government.[1] Further reporting by the Globe and Mail with other leaked CSIS documents alleges that China used diplomats and a network of “Canadian friends” to influence candidates in federal elections. It is worth noting that some have questioned the reliability of the CSIS documents, noting that intelligence reports, particularly internal ones, should often be read as simply a collection of rumours and intelligence gathering. However, regardless of the reporting itself, the story took on a life of its own in the public sphere and thus the political realm with public reaction to the story having a great impact on Canada-China relations.

Embroiled at the heart of all this is Prime Minister Trudeau, who not only is the leader of the same Liberal party that China is reported to favour but has had his own personal connections come into play. A report on election integrity was published on February 28th by Morris Rosenburg indicating that both the 2019 and 2021 elections had not been comprised by foreign interference. However, due to Rosenburg's ties with the Pierre Elliott Trudeau Foundation, opposition parties and some media criticized his integrity. In March 2023 it was announced that the Pierre Elliott Trudeau Foundation would return $200,000 donated by Chinese billionaire Zhang Bin, due to the perception it may have come from the Chinese government to buy influence. All of this meant that by the time Trudeau announced he had appointed former governor general David Johnston as special rapporteur to look into election interference many parties and media were calling for a public inquiry, which, due to the subsequent resignation of Mr. Johnston as special rapporteur, looks more and more likely.

Critically, the Canadian reaction to this news, both with regards to China as well as its own leader, affects trade and investment in a few important ways. The first is that under the current political climate, any interaction with Chinese entities is now under intense scrutiny, not only does this make it less likely for new investors and companies to do business with China in Canada due to potential bad press, but it also strains long standing relationships which are now subject to renewed inspection. Thus economic ties and relationships that in the past would not have raised any concerns may now be seen as risks.

Not only does increased skepticism of China constrain businesses cooperation with Chinese entities, but it also limits politicians' ability to engage China due to fears of political backlash for looking soft on China. Recent polling has found that 62% of Canadians think the Canadian government should view China as an “enemy of Canada” or a “potential threat to Canadian interests” (22% and 40% respectively). Thus, the political climate for cooperation with China on important issues such as trade and climate is becoming more and more difficult. The first quarter of 2023 has seen the further deterioration of Canada-China relations even among increasing economic dependency on China as an export destination. In conclusion, Canada's delicate dance balancing frosty diplomatic relations and deepening economic ties continues, raising questions about the impact that worsening diplomatic tensions will have on economic cooperation and underscoring the critical need for a nuanced approach that navigates these complexities without sacrificing Canada’s economic and political interests.

[1] Trade deficits and surpluses are not inherently good or bad because they are simply measurements of the flow of goods and services between countries, and their implications depend on the specific circumstances, economic health, and future prospects of the nations involved.

[2] Please note that some sums and percentage points may not add up perfectly on tables and graphs due to rounding.

[3] It is important to note that at the time of publication of this trade update (June 22nd, 2023) there is no definitive evidence to indicate that China was able to actually sway the results of any election, however the act of interference if of course of grave concern in and of itself.

Author

Karel Brandenbarg

Policy Research Assistant

Karel graduated from the BA Honors program at the University of Alberta with a major in Political Science and double minor in Economics and Philosophy. His honor thesis focused on the ethical implications of realist International Relations theory.