Canada-China Trade: Q3 2023

Daniel Lincoln, Louis Butt, Jack Burnham - 6 February 2024

Canada-China Trade: Q3 2023

Canada’s trade relationship with China is key in shaping both the everyday functioning of the Canadian economy and our overall engagement with the world’s second-largest economy. As our second-largest trading partner after the US, Chinese trade with Canada is deeply linked with the economic wellbeing of our country as a whole. Canada-China trade assumes great importance as it lies at the intersection of broader economic and political developments affecting both countries, and an examination of bilateral trade between the two countries sheds light on a wide variety of crucial ongoing and future developments in Sino-Canadian relations.

The quarterly Canada-China bilateral trade report seeks to provide a concise and informative overview of both the central trends materializing in the trade relationship and the main factors that affect them. The following combination of thoroughly described trade data and analysis of broader economic and political trends that drive quarterly developments supplies a unique insight into Canada-China trade dynamics. As Canada’s engagement with China becomes more complicated and affected by various factors, this analysis is one of the clearest tools for examining how our relationship with China evolves over time, as trade is among the most important facets of overall ties between Canada and China.

Quarterly Data

In tandem with a slowing Chinese economy and an increasingly unpredictable economic environment, Canadian exports to China are experiencing progressively slower growth, while Chinese imports to Canada have faltered so far throughout the year.

Indeed, although Canadian exports to China have grown on a year-over-year (YoY) basis, the rate of growth has slowed over each quarter of this year. This indicates that the growth rate of Canadian exports is on a negative trajectory over the course of the first nine months of 2023, a trend that was noted in the Q2 trade report. Meanwhile, Canadian imports from China remain lower compared to 2022, though monthly data through the first nine months of 2023 shows that imports are fluctuating from month to month. Although the trade deficit reached a 24-month low in February 2023, it has grown since then on a month-to-month basis, given that the growth in exports has slowed. Nevertheless, the bilateral trade deficit in the first nine months of 2023 has been smaller than it was in 2021 and 2022, largely due to decreasing Canadian imports from China.

The following data is gathered from Statistics Canada for goods (merchandise) trade with China, presented on an unadjusted customs basis in Canadian dollars (CAD). The relevant HS 4-digit identification code is used to identify product groups. All values are in Canadian dollars (CAD).[1]

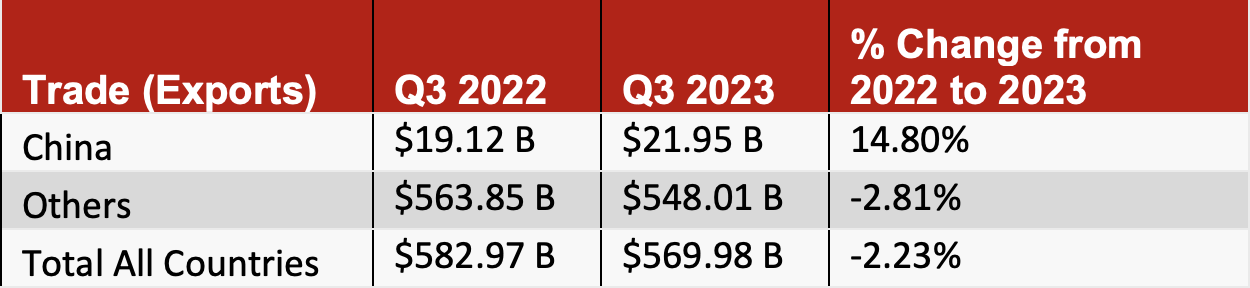

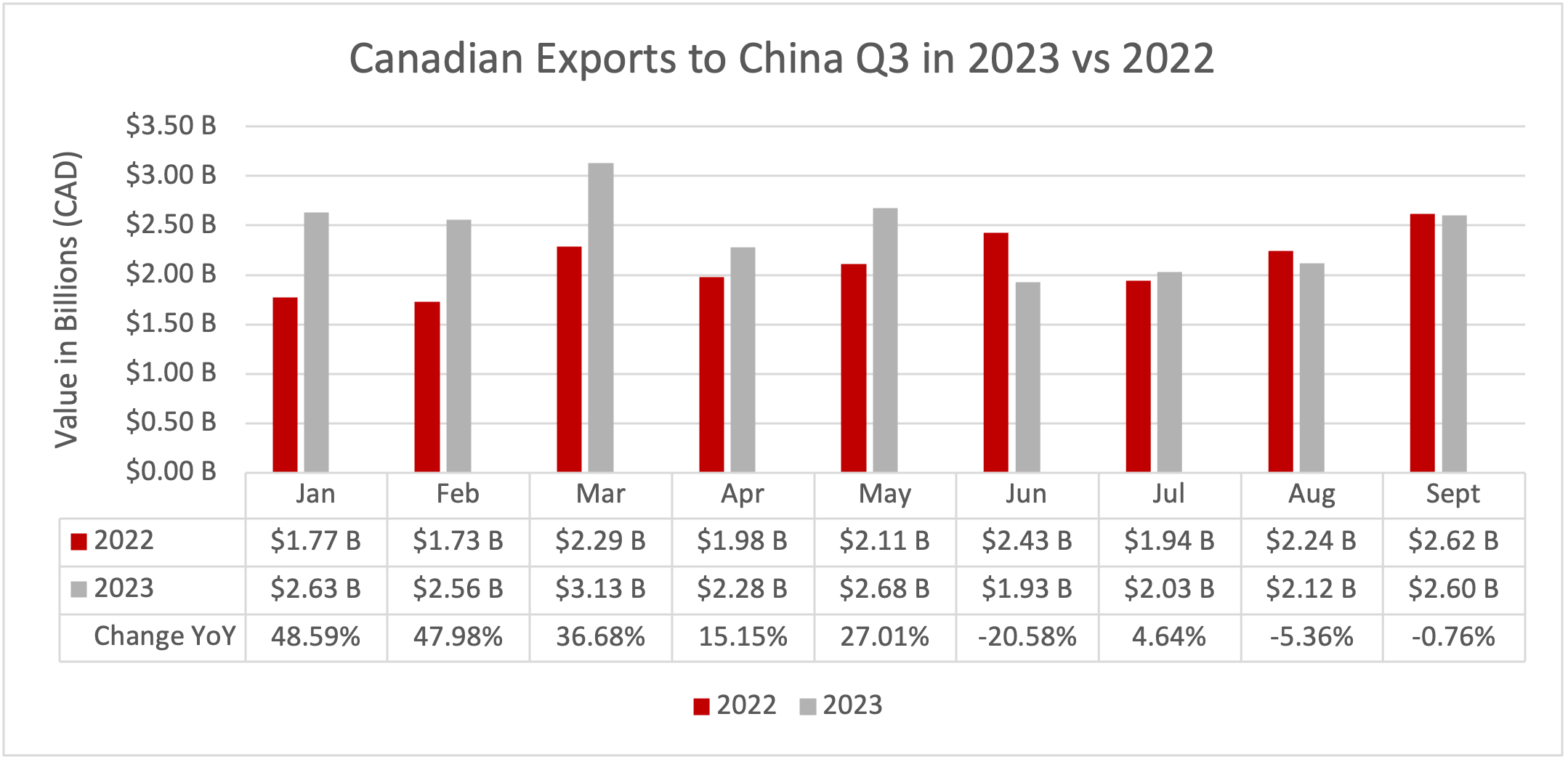

Exports from Canada

Canada’s exports to China rose modestly from Jan.- Sept. 2022 to Jan.-Sept. 2023, even as Canada’s exports to other countries declined during the same period. Canada’s exports to China rose by 14.80% year-over-year (YoY) to $21.95 billion, while exports to all other countries declined by 2.81% YoY to $548.01 billion. As seen in the chart below, much of this growth in exports occurred during the later winter months, while this trend slowed and partially declined during the summer and into the fall. While Canada exported $3.13 billion in products to China in March of 2023, this had fallen to $1.93 billion in June before slightly recovering in September to reach $2.6 billion. The pace of export growth to China has slowed continuously over the course of the year thus far. In Q3 2023, Canadian exports to our largest trading partner, the US, increased by 0.4% YoY. Growth in exports to our second- and first-largest trading partners has led to a reduction of Canada’s overall trade deficit in the period of Jan.-Sept. 2023.

In the first nine months of 2023, exports of canola[2] experienced an impressive 265.68% YoY growth rate, reaching $2.81 billion and becoming the top Canadian export to China. Conversely, despite being the second-most exported product as measured by value, coal[3] saw a YoY decline of 24.49% to $2.2 billion. Exports of iron[4] grew by 13.08% YoY to reach $1.76 billion, positioning it as the third-most exported product to China. The fourth-most exported product, chemical wood pulp [5], showed a modest YoY growth rate of 3.97%, amounting to $1.60 billion. Finally, exports of copper[6] to China expanded by 18.79%, totaling $1.13 billion and making it the fifth-largest Canadian export to China. Overall, these export figures highlight the resilience of Canadian exports to China, given that while they grew 14.80% YoY in Q3, total Chinese imports from all countries decreased 6.2% YoY in the same period.

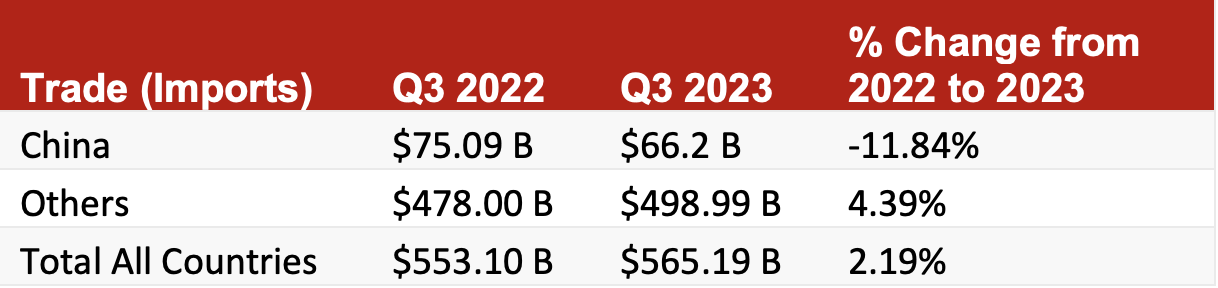

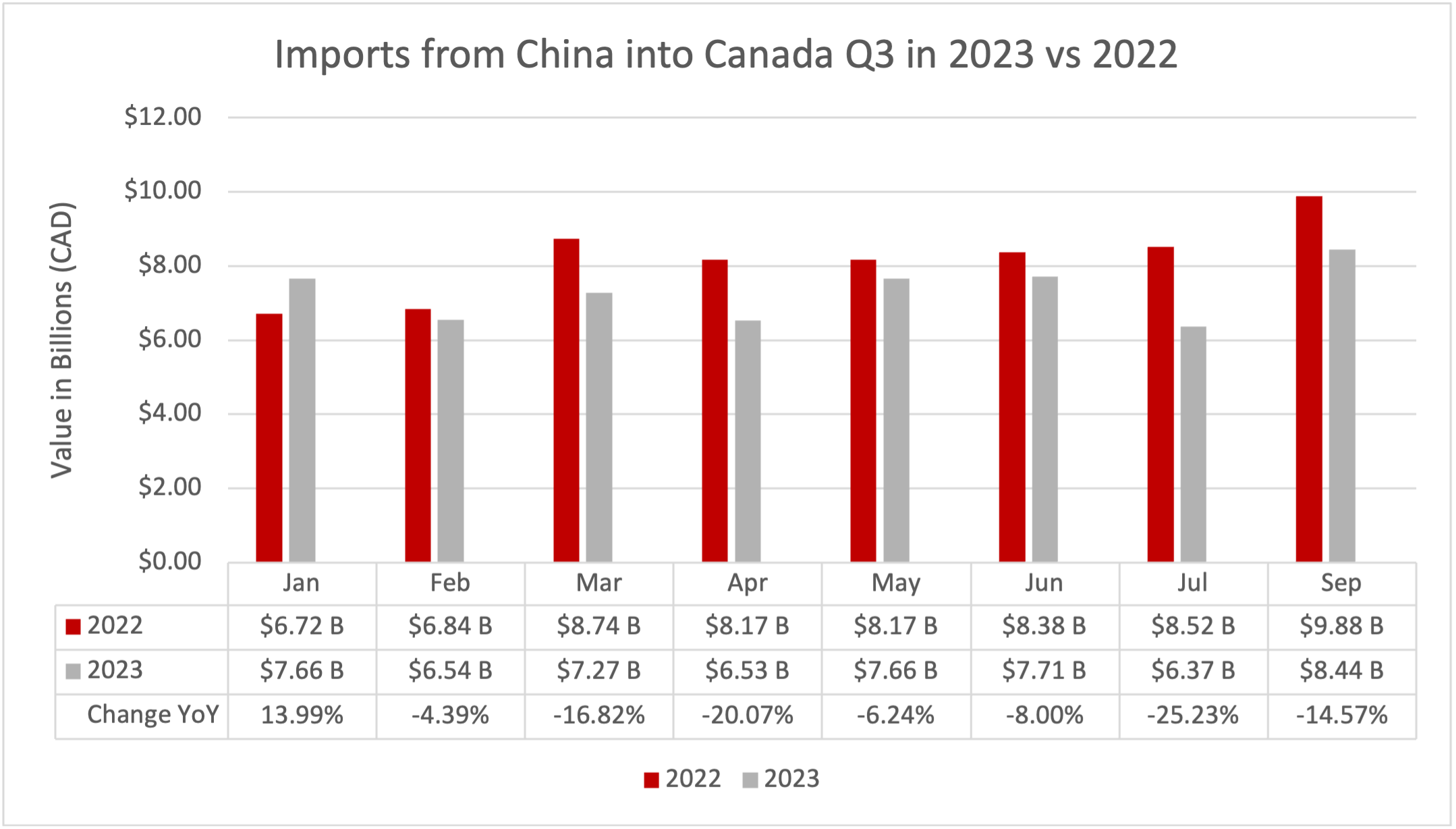

Imports to Canada

In contrast to exports, Canadian imports from China witnessed a YoY decline of 11.84% from Jan.- Sept. 2022 to Jan.-Sept. 2023, even as total Canadian imports grew by 2.19% YoY during the same period. As shown in the chart below, YoY growth rates for imports declined each month following January 2023, with the largest YoY contraction occurring in April 2023. This trend continued throughout the summer, as July 2023 saw only $6.37 billion in imports, their lowest value during this period. At the same time, Canadian imports from the US contracted by 0.9% YoY, indicating that American and Chinese exporters are both currently experiencing headwinds in Canada. Major trading partners that have seen their exports to Canada grow in the first nine months of 2023 include Mexico (14.3%), France (4.3%), and the UK (15.3%).

The most imported good from China in the first three quarters of 2023 was cellphones[7], but with a YoY decline of 5.28% to reach $6.20 billion. The vast majority of these cellphone imports are Western brands manufactured in China such as Apple and Samsung, with Chinese brands such as Huawei and Xiaomi having minimal presence in the Canadian market as of 2023. The second-largest import category in this period was automatic data processing machines (e.g., computers)[8], which also decreased by 21.68% YoY, dropping to $4.81 billion for the year-to-date. Passenger vehicles[9] experienced a remarkable growth of 398.59% YoY, rising to $1.98 billion and placing them as the third-most imported good from China. The meteoric rise in Canadian imports of Chinese passenger vehicles appears to have been driven by Shanghai-produced Tesla EVs, as opposed to Chinese EV brands such as BYD that have made significant inroads in the European market recently but are currently unavailable in Canada. Heaters[10] also grew by 131.75%, positioning them as the fourth-largest import category with a value of $1.80 billion. Finally, vehicle parts[11] came in as the fifth-largest import from China, showcasing a modest 3.40% YoY growth rate, bringing their total value to $1.79 billion.

Canada-China Trade: Last 24 Months

The last 24 months of China-Canada bilateral trade highlight several key trends that have taken place within the trading relationship. So far in 2023, imports have behaved erratically, with significant fluctuations in the volume of Chinese imports from month to month. Meanwhile, although exports have performed better overall on an annual basis, it is clear that Canadian export growth has been stagnating since June, although September did experience marginal export growth. Canada’s trade deficit has grown overall after the winter of 2023, although it has been quite stagnant month-over-month since June, notwithstanding the outlier of July. Overall, the trajectory of Canada-China trade is difficult to discern given drastic fluctuations in imports throughout 2023, though imports from China do appear to be experiencing a slight recovery from May onwards, except for July. Slowing growth in exports in conjunction with a modestly positive trajectory for import growth indicates that the trade deficit will likely expand slightly in Q4 2023.

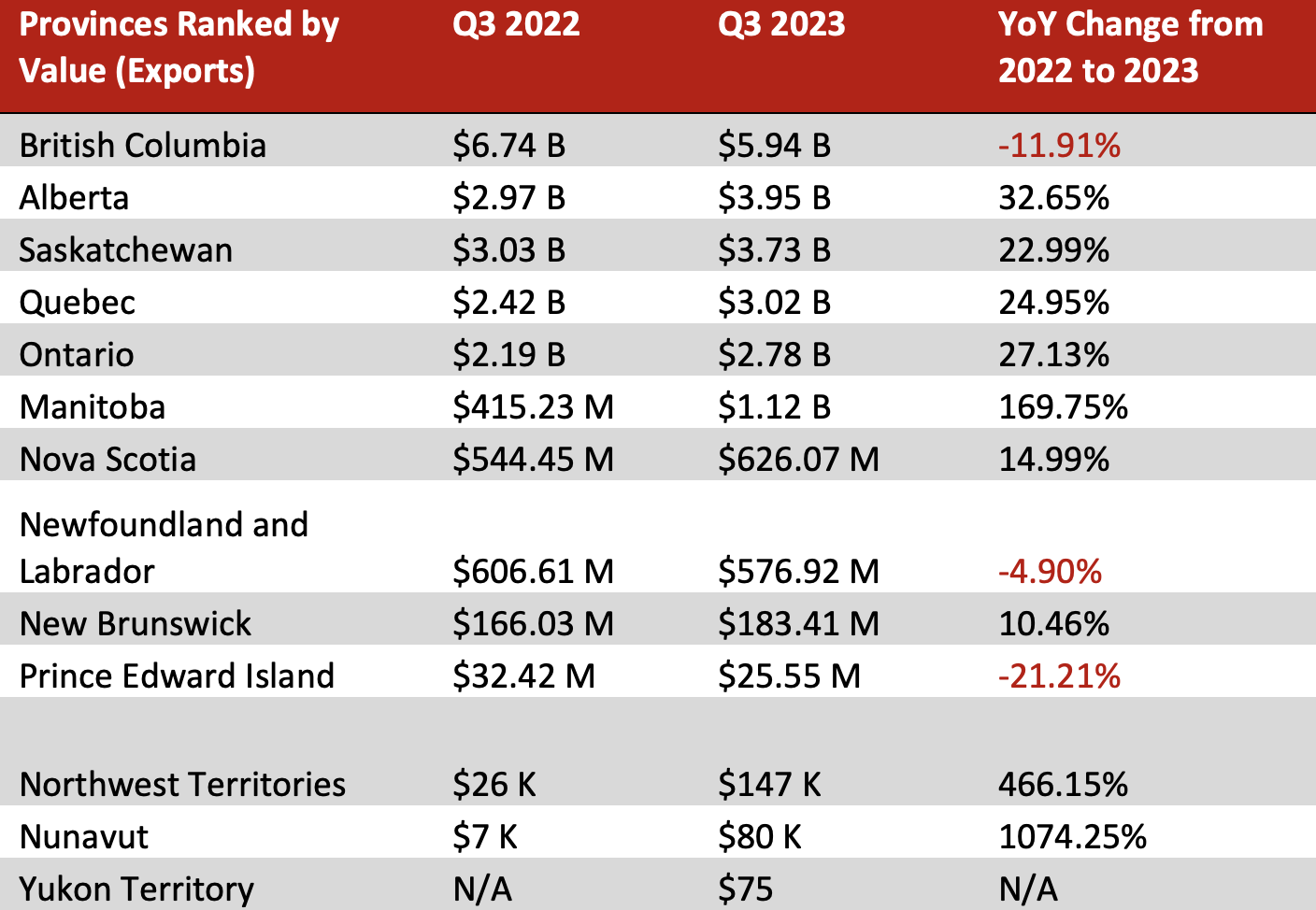

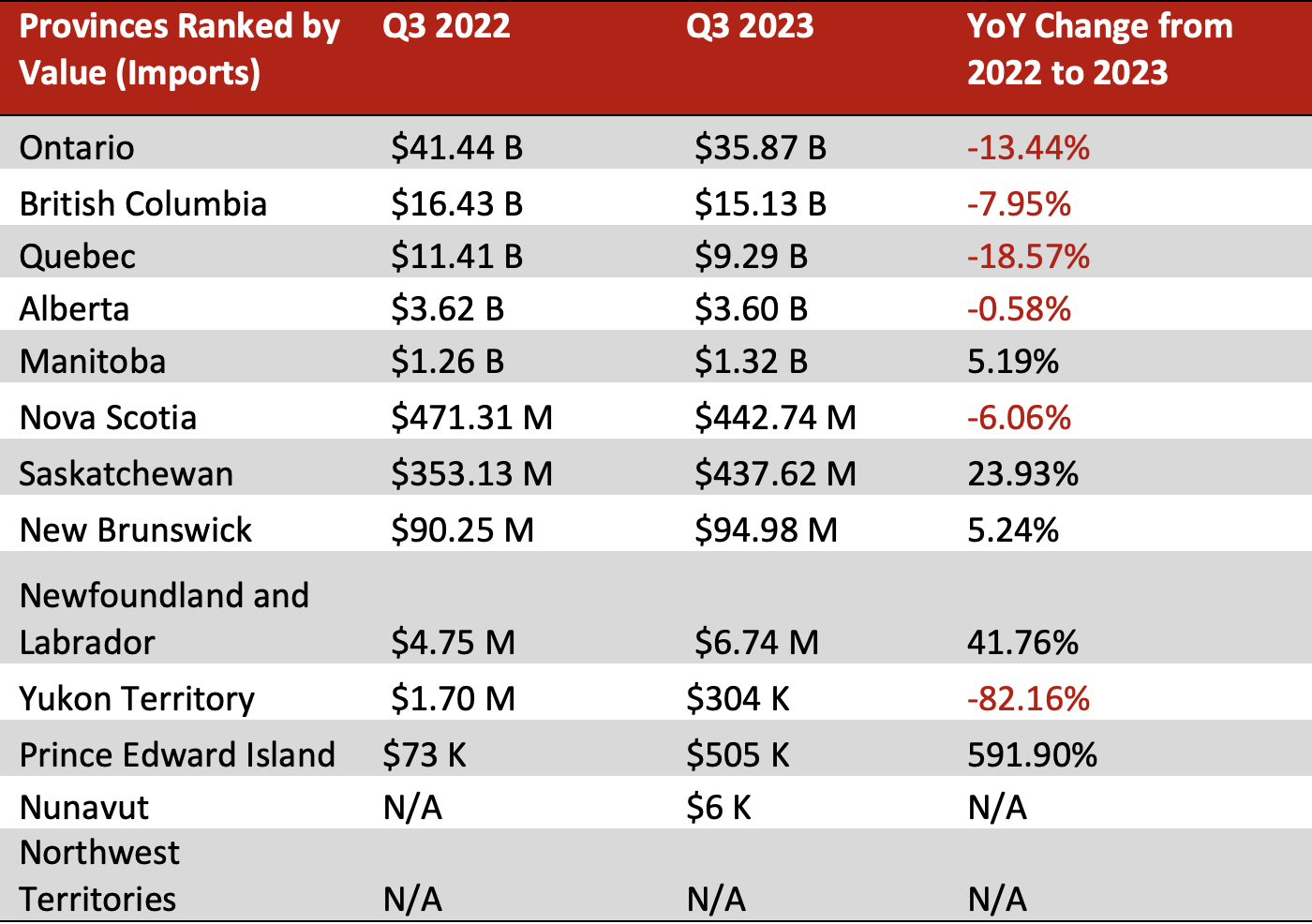

Jan.-Sept. 2023 Canada-China Trade: By Province/Territory

Most provinces experienced YoY growth in exports to China in Q3 2023, in line with national trends. The only provinces that witnessed a decline were British Columbia (-11.91%), Prince Edward Island (-21.21%) and Newfoundland and Labrador (-4.90%). A factor that may have influenced decreased exports from British Columbia is the 13-day port strike in July that significantly disrupted trade flows in that province. The Prairie Provinces all experienced robust export growth, which was likely influenced by their large agricultural industries and the large growth in exports of goods such as wheat and Canola to China this year. Despite the annual contraction in exports from British Columbia, the coastal province still holds the top spot in total export value, accounting for $5.94 billion in 2023 so far.

In contrast, most Canadian provinces witnessed a slight-to-moderate YoY decline in imports from China, with several exceptions. The drop in imports is likely affected by the rising cost of living in most provinces, as noted in the Q2 2023 report. This observation is corroborated by the fact that Alberta has the strongest economic performance of the most populated provinces this year, and similarly experienced the smallest contraction in imports from China (-0.58%) among these provinces. Similarly, the other Prairie Provinces saw their imports of Chinese goods expand, with Saskatchewan and Manitoba registering growth rates of 23.93% and 5.19%, respectively, which is also likely driven by robust economic performance in these provinces. Import growth in Prince Edward Island (591.90%), New Brunswick (5.24%), and Newfoundland and Labrador (41.76%) is likely driven by lower levels of household debt in these provinces, which is one of the main factors driving lower consumer spending elsewhere in Canada.

Trends and Topics

Unclear Horizons: Inconsistent Chinese Economic Rebound and Opportunities for Canadian Producers

After experiencing a significant downturn in Q2 2023, the Chinese economy beat mainly pessimistic forecasts and displayed modest signs of recovery in Q3. This quarter saw China display a 1.3% quarterly growth rate, with the country having reached a 5.2% year-on-year growth rate for the Jan.-Sept. 2023 period, in line with Beijing’s goal of “around 5%” growth for 2023. Several metrics illustrate the gains made by the Chinese economy in Q3 2023. Retail consumption and the service industry grew by 6.8% and 6.0% year-over-year in the first nine months of 2023, respectively, with September in particular exhibiting robust growth. Similarly, urban unemployment reached 5.0% in September, marking its lowest level since November 2021. The price index (an indicator of inflation) across all sectors reached 50.9 in September, indicating that China may have avoided deflation in Q3, which in Q2 was viewed by observers as one of the greatest challenges facing the economy. Overall, these figures signal that China’s economy gained some much-needed breathing room in this quarter.

However, despite assertions by many analysts that the Chinese economy bottomed out in Q2 and is now on the road to a comprehensive post-COVID recovery, several factors complicate overly optimistic assessments of the country’s current macroeconomic environment. Firstly, many of these growth figures are affected by the low-base effect, wherein growth statistics are high specifically due to a particularly low starting point. China’s poor economic performance in 2022 means that the year-over-year growth figures are not necessarily indicative of a return to the historic status quo of high Chinese growth, but rather mark a modest rebound from the downturn caused by COVID-19 lockdowns. The underperformance of the Chinese economy relative to the pre-COVID era is highlighted by some metrics of economic vitality currently being below 2019 levels, such as consumer spending. Secondly, the ongoing real estate crisis in China continues to act as a significant drag on the economy as a whole. Although investment increased throughout other sectors of the economy, significant contractions in real estate investment negated these gains, leading to a contraction of 0.6% in total investment. The disproportionate size of China’s real estate sector – amounting to approximately 26% of GDP – means that continued malaise in the property sector will significantly impact the prospects of near-term economic growth. Thirdly, the cascading effects of the property crisis have weighed heavily on consumers. Uncertainty about the economy as a whole arising from the downturn in the real estate sector has led to diminished consumption and increased savings. The upturn in consumer spending in Q3 2023 may be partly driven by the first post-COVID Mid-Autumn Festival, which is corroborated by the strongest performance of the quarter occurring in September when celebrations occurred. This uptick in consumer spending caused by large Chinese holidays was also observed in Q1, when Lunar New Year celebrations led to high spending in late January and early February. Finally, the decision by Chinese authorities to suspend reporting of poor economic statistics – namely the youth unemployment rate – has likely eroded investment confidence due to decreased economic transparency, which could hamper future investment.

Canadian exports to China spiked in Q1 2023 due to the reopening following zero-COVID, reaching a year-to-date high of $3.13 billion with 36.68% annual growth, but faced a slowdown in Q2, marked by a June year-over-year contraction of 20.58%, which coincided with China’s economic downturn. Following these two quarters, Q3 has seen a modest rebound from the low point of June 2023, although August and September experienced a 5.36% and 0.76% contraction in exports, respectively. While Canadian exports to China have grown overall thus far in 2023, the rate of growth is decreasing progressively over each quarter of the year. This is partially due to the massive increase in Canadian exports in Q1 likely being reflective of suppressed demand following zero-COVID, while current export numbers are likely closer to actual levels of demand.

The performance of several Canadian exports to China demonstrates ongoing opportunities for many domestic exporters. One of Beijing’s ongoing strategic goals is to achieve food security, although it has encountered obstacles in achieving this, such as climate change-related disruptions in domestic food production and the ongoing invasion of Ukraine. Canadian agricultural producers have gained from these setbacks, with significant increases in Canadian exports of wheat (65.36%), canola (265.58%), soybeans (205.29%), and barley (112.59%) to China. However, the future sustainability of this trend may be affected by an unprecedented US$25 billion grain deal China signed with Russia in October 2023. Nevertheless, given that this deal pertains to trade over a 12-year period, Canadian wheat will likely continue to be instrumental in meeting China’s massive food demand. Furthermore, Canadian seafood producers gained a lucrative opportunity in the Chinese market during Q3 after Beijing declared a ban on Japanese seafood imports due to the discharge of wastewater from the Fukushima nuclear power plant. This ban has likely contributed to a 15.11% increase in seafood exports to China in the first nine months of 2023, even as total seafood exports to all countries have decreased by 3.80%. This illustrates that even amid an uncertain economic situation in China, many Canadian businesses have opportunities to expand their presence in the country’s massive consumer market, especially in terms of meeting demand for essential raw goods, such as food.

Despite many Canadian sectors currently experiencing success in the Chinese market, other exporting industries are facing challenges. For example, Canadian fertilizer exports to China have seen a notable decline of 50.68% in the first nine months of 2023. Two factors have contributed to this drop in fertilizer exports. Firstly, sanctions on Russia – the world’s largest fertilizer exporter – have disrupted the global flow of fertilizers, contributing to increased prices and thus a significant reduction in global demand. Secondly, China curbed exports of its domestically produced fertilizers, further increasing global prices and fortifying its domestic supply. Therefore, Canadian fertilizer producers are facing headwinds in the Chinese market, which are likely to continue for the foreseeable future, as the causes of the rise in global fertilizer prices are likely to endure. As China stockpiles fertilizer to ensure its access to this essential good, the country’s demand for the product from foreign suppliers – including Canada – will likely trend lower.

Consumption Slump: Continued Economic Slowdown Weighs on Canadians

Canada’s economy has continued to experience headwinds throughout Q3. In this quarter, Canada’s GDP experienced a 0.3% contraction and saw both overall exports and imports decline quarter-on-quarter by 1.3% and 0.2%, respectively. These figures were lower than the Bank of Canada’s prediction of a GDP growth rate of 0.8% in Q3. While economists have emphasized that it is too early to say that Canada is in a recession, they have also warned that factors such as falling business investment, flat consumer spending, and high household debt will likely weigh heavily on Canada’s economy moving forward. This uncertain macroeconomic environment has led to decreased investor and consumer confidence, with the American Chamber of Commerce in Canada stating that investment sentiment in Canada is at an all-time low. However, Canadian consumers did receive some relief from inflation in Q3, with inflation numbers decreasing on an annual basis across all sectors other than mortgage interest costs. Undoubtedly, just as in Q2, continued economic uncertainty in Canada has contributed to decreased imports from China, given that the majority of Chinese imports are consumer goods.

Domestic political events in Canada also impacted the flow of trade during the summer. In July, a labour dispute in British Columbia led to a 13-day strike of port workers, which paralyzed 30 marine trade terminals in that province and caused an estimated disruption of $10.7 billion in trade. As a result of this strike, imports from Pacific countries declined as trade with China hit its low point in July, marking its lowest point in the past 24 months and an 11.88% decrease in average monthly imports. However, the months following the strike saw a surge in imports from China, likely due to a backlog of goods reaching BC ports. This event, unique to Q3 2023, is clearly reflected in the import data for the year-to-date and is one of the major events that contributed to the downturn in imports in the quarter.

Although Canadian imports from China were subdued in Q3, the quarter did see positive developments in terms of specific Chinese goods imported to Canada. For example, the impressive 398.59% surge in vehicle imports from China underscores the momentum of China’s electrical vehicle (EV) sector, as supported by its position as the primary global producer of EV batteries. Although Chinese brands such as BYD are unavailable in the Canadian market, Tesla began listing its Shanghai factory-made Model 3 and Model Y in Canada. While Tesla does not report regional sales numbers, this likely plays a large part in the US$1.1 billion worth of EVs that reached Canadian shores from China this year. Moving into the future, it is likely that this sector will grow in importance within Canada-China trade, especially as Canada increasingly adopts EVs to fulfill its climate goals. However, Chinese EV brands may lack brand recognition among Canadian consumers and could be subject to geopolitically-motivated import restrictions. Therefore, it is quite possible that future growth in Chinese EV exports to Canada will be in the form of non-Chinese models produced in China, such as Tesla.

Moving forward, the economic challenges faced by Canada will continue to have an effect on the bilateral trade relationship, particularly in terms of goods imported from China. As economists predict that Canada will likely face a recession moving in 2024 it is likely that Canadian demand for consumer goods will continue to experience a protracted downturn. As the majority of Canadian imports from China are consumer goods – particularly non-essential products like new electronics – it can consequently be expected that Canadian imports from China will continue to decline in line with this trend for the foreseeable future.

Shifting Winds: Changing Trade Linkages Lead to Lower Imports from China

While macroeconomic conditions are key in explaining trade flows between China and Canada, shifts in the sourcing of consumer goods bought by Canadians also play a significant role in the changing nature of Canada-China trade. Economic and geopolitical developments have jointly contributed to an increasing trend of Canada – along with other Western countries – relying less on Chinese goods and pivoting towards other emerging economies to import products historically sourced from China. This transformation in trade dynamics has grown more prominent as a result of economic disruptions occurring during the COVID-19 pandemic, changing labour costs, and intensifying US-China competition.

In line with other Western nations, Canada has increasingly moved to diversify its trade relations as part of a greater strategic effort to reduce its trade dependence on China. The main factors driving Canada to reduce its reliance on Chinese imports have been perceptions of risk and the rising cost of Chinese labour. As outlined in Canada’s Indo-Pacific Strategy, Ottawa views China as a “disruptive global power” and has prioritized increasing its cooperation with other partners in the Indo-Pacific region as a means of mitigating potential issues that could arise from geopolitical competition with Beijing. However, Canada’s desire to reshuffle its trade relationships away from China and towards other emerging economies is also influenced by shifting economic factors such as increasing Chinese labour costs, which in turn increases the cost of Chinese imports. This has not only influenced China-Canada trade, but China’s trade with the world at large.

One of the key regions prioritized by Canada under its Indo-Pacific Strategy is the Association of Southeast Asian Nations (ASEAN). In September 2023, Canada formally entered into a strategic partnership with ASEAN, and has been negotiating a free trade agreement with the 10-nation bloc. These initiatives have served to bolster Canada’s trade engagement with the region’s emerging economies, which have increasingly become a major centre of international consumer goods production given their relatively low cost of labour and deep integration into global supply chains.

Trade statistics for the first nine months of 2023 illustrate the degree to which the deepening trade ties with ASEAN countries have accompanied a decline in Canadian imports from China. The two most imported goods from China in Q3 2023 were cellphones and computers, although imports of these products experienced a year-over-year decline of 5.28% and 21.68%, respectively. While an ongoing economic slowdown in Canada is undoubtedly a factor in this, trade flows with ASEAN economies over the same period indicate that shifting supply chain dynamics are also influencing decreased imports from China. For example, Canadian imports of cellphones from Vietnam and Indonesia increased by 16.0% and 2210.0%, respectively. Likewise, Canadian imports of computers from Vietnam increased by 164.7%.

Furthermore, India, a rapidly emerging economic powerhouse in the Indo-Pacific that is not a member of ASEAN, has also experienced massive growth in exporting products traditionally dominated by China to Canada. For example, exports of cellphones from India to Canada have grown by 363.10%. These figures illustrate that increasingly sophisticated manufacturing bases in these emerging Indo-Pacific markets have strengthened their trade relationship with Canada, especially in terms of products typically imported from China, such as consumer electronics.

While it may appear that emerging Indo-Pacific economies are beginning to replace China in Canada’s international trade profile, two factors demonstrate the enduring importance of China as a key economic partner for Canada. Firstly, China continues to dominate Canadian imports of consumer electronics such as cellphones, although ASEAN countries like Vietnam, Indonesia, and Malaysia are making rapid progress. For example, Vietnam has become the second-largest supplier of cellphones to Canada, with the total value of these exporters now equaling one-third the value of Canadian imports of Chinese cellphones, as opposed to a mere 10% in 2022. Secondly, China’s deep integration into ASEAN economies means that trade with the bloc necessitates cooperation with Chinese stakeholders as a result of extensive Chinese investment in the region. This means that while Canada may import less from China and more from emerging economies in ASEAN, engagement with Chinese investors and businesses will remain greatly important for Canadian trade overall, although the nature of this relationship will be less direct than it is with importing goods produced in China itself.

Ultimately, economic and geopolitical factors are driving the evolving trade dynamics in the Indo-Pacific region. This is not unique, and is reflective of broader trends occurring among most advanced economies. Perceptions of risk and the rising cost of labour in China are currently inducing major Western companies to reorganize their supply chains away from China. For example, in recent years, Apple has increasingly pivoted its production of electronics from China to other regional emerging economies, such as Vietnam and India. These developments are exacerbated by policies enacted by Western governments, such as the Biden administration’s Inflation Reduction Act (IRA), which has sought to cut Chinese EV producers (and adjacent industries such as lithium battery producers) out of the US market due to competition between China and the United States. Such efforts by Western nations to “de-risk” their trade relations by decreasing reliance on China have also led to a degree of reciprocation by Beijing. China is pursuing its dual-circulation strategy, which seeks to place high-tech manufacturing and domestic consumption at the forefront of future Chinese economic growth, as opposed to the lower value-added exports which drove its economy in the past. These evolving trends mean that Canada may import fewer goods from China in the future, as the current profile of Canadian imports from China is dominated by cheaper consumer goods. However, China’s ongoing manufacturing sophistication means that Canada could also be a future consumer of higher value-added products from China like solar panels, batteries, and EVs given Beijing’s growing dominance in these fields.

Even as ASEAN’s rise as a manufacturing hub with high economic vitality will likely help make it a future key trading partner for Canada, China will continue to be crucial to the Canadian economy both directly and indirectly. This is due to both China’s continuous development of its manufacturing base and its significant investment presence throughout the developing world. The China Institute (TCI) has been closely monitoring these complex developments, and will continue to provide in-depth analysis of how the global economy is being affected by the impact of US-China tensions on countries that wield growing economic and geopolitical influence around the world.

[1] Please note that some sums and percentage points may not add up perfectly on tables and graphs due to rounding.

[2] HS4 product group: 1205 – Rape or Colza Seeds (Whether or Not Broken)

[3] HS4 product group: 2701 – Coal and Solid Fuels Manufactured from Coal

[4] HS4 product group: 2601 – Iron Ores and Concentrates

[5] HS4 product group: 4703 – Chemical Woodpulp – Soda or Sulphate

[6] HS4 product group: 2603 – Copper Ores and Concentrates

[7] HS4 product group: 8517 – Telephone Sets; Other Apparatus For Trans/Recep of Voice/Image/Data, O/T 84.43, 85.25, 85.27, 85.28

[8] HS4 product group: 8471 - Adpm & Units, Magnetic/Optical Readers, Machine Transcribing Data To Media in Code & To Process

[9] HS4 product group: 8703 – Motor Cars and Other Motor Vehicles Principally Designed for the Transport of Persons (Other Than Those of Heading 8702), Incl. Station Wagons/Racing Cars

[10] HS4 product group: 8419 – Non-Domestic Dryers and Temperature Changing Apparatus; Instantaneous Water Heaters

[11] HS4 product group: 8708 – Motor Vehicle Parts (Excl. Body, Chassis and Engines)

Authors

Daniel Lincoln

Policy Research Assistant

Daniel is a recent graduate of the University of Alberta, completing a BA With Distinction in Political Science, Economics, and History. Daniel also received a Certificate in Globalization and Governance that he completed in conjunction with his undergraduate degree. His primary research interests include Russian and Chinese foreign policy, international trade, security policy, and Canada's geopolitical and economic role in the Arctic.

Jack Burnham

Policy Research Assistant

Jack Burnham recently graduated from the Max Bell School of Public Policy at McGill University with a Master of Public Policy (MPP). Jack has previously worked at the NATO Association of Canada as a Junior Research Fellow writing for the Centre for Disinformation Studies, and his primary research interests include defence policy, great power competition, and US foreign policy in the Indo-Pacific region.

Louis Butt

Policy Research Assistant

Louis holds a BA in History and Political Science from the University of Toronto and an MA in Conflict, Security and Development from King's College London. Before joining the China Institute, Louis worked in public affairs in Ottawa. His research interests include state development as well as defence, energy and foreign policy. Louis speaks fluent French, Spanish, and intermediate Japanese and Italian.