Action-Oriented Public Health Resources on Financial Wellbeing and Financial Strain

Improving people’s financial circumstances has never been more critical. Disadvantaged population groups have experienced even higher levels of financial strain and poor financial wellbeing during the pandemic. This has negatively impacted their physical and mental health.

To support efforts to build back better and fairer communities in the wake of COVID-19, the Centre for Healthy Communities led an international collaborative, participatory, multi-method project to develop resources to support action on financial strain and financial wellbeing. These resources were designed for practitioners and decision-makers working in organizations and governments in a wide variety of sectors and jurisdictions.

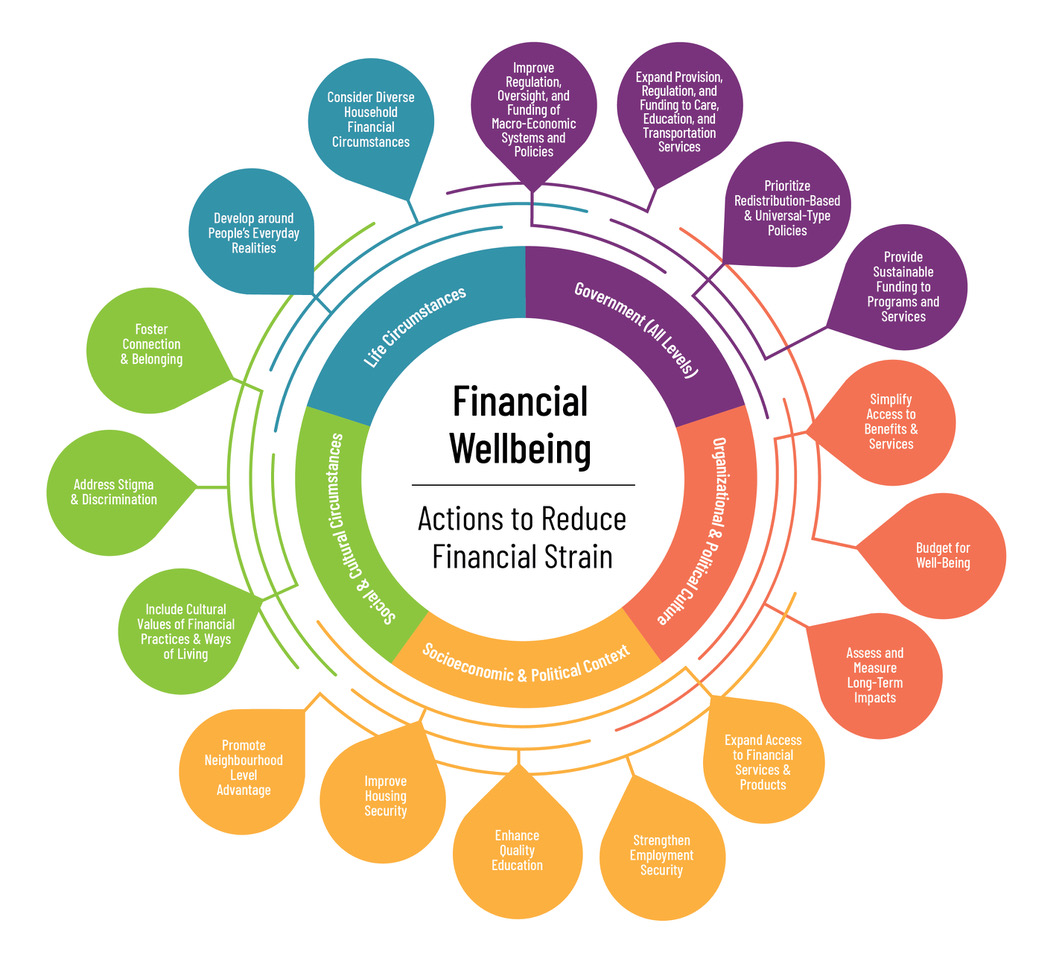

This project resulted in an action-oriented Public Health Framework on Financial Wellbeing and Financial Strain and a companion Guidebook of Strategies and Indicators (see below). These resources are meant to support organizations and governments acting on any area related to financial strain and financial wellbeing, such as education, employment, or social safety net, to name a few. The Framework, which draws on health equity and health-in-all-policy principles, presents 17 evidence-informed high-impact areas for governments and organizations to intervene. The Guidebook offers evidence-informed targets and strategies for initiatives, as well as sample indicators for monitoring and assessment for each of those 17 entry points for action.

English Framework and Guidebook Resources

French Framework and Guidebook Resources

Household income and homeownership are well-known determinants of health. But other aspects of personal financial situations also matter to health, whether they are present circumstances or what we expect about the future. The feeling of not being able to make ends meet by the end of month, poor credit score, low or no savings - just to name a few - are related to poor physical and mental health outcomes. We all may experience financial strain and poor financial wellbeing to some degree in our lives. These experiences can be short-term or long-lasting, but either can have lasting impacts on health. Expected or unexpected life or employment-related events (e.g., birth of a child, job loss, mandatory retirement, permanent disability) can cause financial stress in our lives.

People do not have to be experiencing poverty to experience financial strain or its consequential adverse impacts on health. Despite much attention to poverty in public health, it does not represent the broader spectrum of people experiencing financial stress. Poverty is often defined in terms of income and daily per capita consumption; it reflects the precarious access to resources to meet basic needs (i.e., food, clothing, and shelter) and services, like transportation, education, and healthcare. Financial strain and financial wellbeing are relatively new concepts that capture experiences of those who often “fall through the cracks” of programs, policies, or services focused solely on poverty. We can define financial strain as a person’s poor perception of their financial situation, regardless of their income and assets. Financial wellbeing combines the subjective dimension of financial strain with objective measures of a person’s financial situation, such as mortgage debt, asset-related debts (e.g., student or vehicle loans), energy poverty, and food insecurity. Only recently we have started exploring the relationships of financial strain and financial wellbeing with health and quality of life.

The COVID-19 pandemic has aggravated perceived and real financial needs for many people, and particularly for those experiencing disadvantage. Socioeconomic and health inequities have substantially widened since 2020. Data from the Financial Consumer Agency of Canada1 show that, in 2021, 62% of people described experiencing more stress in the last 12 months. It also found that 31% of people reported being short on money by the end of month (a statistically significant increase from 19% in 2019). The percentage of people who reported having emergency funds to cover three months of expenses presented a statistically significant decrease from 64% in 2019 to 45% in 2021. When people struggle financially, our country struggles as well. The most recent estimates of financial wellbeing index show that Canada and all ten provinces performed below the benchmark; Alberta endured the lowest financial wellbeing score.2

Some organizations, often from the financial industry, have designed and delivered programs and services to help individuals to reduce their financial strain. Most of those interventions have targeted individual behaviours towards spending, borrowing, and saving. Unfortunately, such interventions have no, or short-lived, positive impact on an individual’s financial situation. For a sustainable, positive impact on health, we must focus on multi-sectoral, population approaches that recognize and address the root causes of financial strain and poor financial wellbeing. This means addressing the structures and systems – beyond an individual’s control – that determine their lifelong health and financial wellbeing.

References:

- Government of Canada, Financial Consumer Agency of Canada. Summary of findings COVID-19 surveys: Financial impact of the pandemic on Canadians. Ottawa: Government of Canada; 2021.

- Morneau Shepell. The Financial Wellbeing Index Report. Morneau Shepell; 2021 January 2021.

As we now transition to a post-pandemic society, this is our chance to build back better and fairer communities for all people to enjoy opportunities to thrive financially and be healthier. It is time for governments and organizations, individually and in partnership, to address the structural causes of financial strain and poor financial wellbeing. This means moving away from band-aid individual-focused solutions to focus on broader population-level strategies. With that idea in mind, the Centre for Health Communities (CHC) partnered with the Centre for Health Equity Training, Research and Evaluation (CHETRE) in Australia to develop an action-oriented Public Health Framework on Financial Wellbeing and Financial Strain and a companion Guidebook of Strategies and Indicators that could be used by high-income countries globally.

The goal of the Framework and Guidebook is to help governments and organizations to address the root causes of financial wellbeing and financial strain that can be found across different sectors (e.g., housing, transportation, education, work industry). These resources are designed for use by a broad, diverse audience. They can be used by policymakers in the federal, provincial/territorial/state, and municipal governments; decision-makers in non-profit or private organizations (e.g., charities supporting violence and abuse victims; employment and training services); health practitioners; community stakeholders; and researchers. Our aim is that use of the Framework and Guidebook will help stakeholders implement effective, evidence-informed initiatives to address the structural determinants of financial strain and financial wellbeing and, ultimately, promote long-lasting positive impacts on people’s financial circumstances and health.

The Action-Oriented Public Health Framework on Financial Wellbeing and Financial Strain and the Guidebook of Strategies and Indicators for Action on Financial Wellbeing & Financial Strain are practical resources to support the design, implementation, and assessment of programs and policies aimed to promote financial wellbeing and reduce financial strain.

The Framework is a model that presents 17 evidence-informed entry points for action where governments and organizations are encouraged to act to promote financial wellbeing at the community and population levels. Examples of entry points for action are: Include Cultural Values of Financial Practices & Ways of Living; Prioritize Redistribution-Based & Universal-Type Policies; and, Budget for Well-Being (see all 17 in the Framework).

These 17 high-impact actionable areas are organized into five domains: Government (All Levels), Organizational & Political Culture, Socioeconomic & Political Context, Social & Cultural Circumstances, and Life Circumstances. The coloured lines in the model illustrate the interconnections between the different entry points for action, indicating that an intervention in one area may have unexpected positive or negative effects on other areas. As such, those interconnections also suggest key opportunities for intersectoral collaboration.

The Guidebook aims to support governments and organizations to build a plan of action. For each of the 17 entry points for action in the Framework, the Guidebook presents specific targets, strategies, and indicators. In total, it provides 62 targets and 140 strategies accompanied by a sample of process and outcome indicators to support assessment of progress and success.

With 2020 Canadian Institutes of Health Research (CIHR) COVID-19 Rapid Research Funding, the CHC and CHETRE partnered to develop the Framework and Guidebook. We used multi-methods and an integrated knowledge translation approach that allowed us to draw on scientific evidence and practice-based knowledge. For example, we conducted a rapid realist review, an assessment of existing frameworks on financial wellbeing and financial strain, a scan of policies enacted or amended in Australia and Canada in response to the COVID-19 pandemic, and a critical literature review on strategies and indicators.

To support the refinement and validation of the Framework and Guidebook, we invited representatives of government sectors, community organizations, and academia in Canada and stakeholders from not-for-profit organizations in Australia. We provided multiple engagement opportunities for decision-makers and stakeholders to share their expertise and knowledge with one another and to provide critical feedback on the content of the Framework and Guidebook.

Promoting financial wellbeing and community health is a cornerstone of future work in the Centre for Healthy Communities. We will work towards developing an interactive web-based version of the Framework and Guidebook to further facilitate the use of these resources. Now that the Framework and Guidebook are available, we will also work with partners and communities to tailor the resources to meet specific population or community needs.

Principal Investigator

Candace I. J. Nykiforuk

Lead Document Development

Ana Paula Belon

Co-investigators

Lisa Allen Scott

Elaine Hyshka

Stephanie Montesanti

Roman Pabayo

Jane Springett

Core Staff

Nicole M. Glenn

Laura Nieuwendyk

Kayla Atkey

Krystyna Kongats

Centre for Health Equity Training, Research and Evaluation, Australia

Principal Investigator

Evelyne de Leeuw

Co-investigator

Patrick Harris

Core Staff

Aryati Yashadhana

Karla Jaques

- Nykiforuk, C.I.J., Belon, A. P., Allen-Scott, L.K. (2023). Untangling concepts of financial circumstances for public health professionals and scholars: A glossary and concept map. American Journal of Public Health,114(1), 79-89. https://doi/org/10.2105/AJPH.2023.307449

- Yashadhana, A., Glenn, N.M., Jaques, K., Belon, A.P., Harris, P., de Leeuw, E., Nykiforuk, C.I.J. (2023). A rapid review of initiatives to address financial strain and wellbeing in high-income contexts. Public Health Research & Practice, 33(2). https://doi.org/10.17061/phrp3322315

- Nykiforuk, C.I.J., Belon, A.P., de Leeuw, E., Harris, P., Allen-Scott, L., Atkey, K., Glenn, N.M., Hyshka, E., Jaques, K., Kongats, K., Montesanti, S., Nieuwendyk, L.M., Pabayo, R., Springett, J., Yashadhana, A. (2023). An action-oriented public health framework to reduce financial strain and promote financial wellbeing in high-income countries. International Journal for Equity in Health, 22, 66. https://doi.org/10.1186/s12939-023-01877-8

- Nykiforuk, C.I.J., Belon, A.P., de Leeuw, E., Harris, P., Allen-Scott, L., Atkey, K., Glenn, N.M., Hyshka, E., Jaques, K., Kongats, K., Montesanti, S., Nieuwendyk, L.M., Pabayo, R., Springett, J., Yashadhana, A. (2023). A policy-ready public health guidebook of strategies and indicators to promote financial well-being and address financial strain in response to COVID-19. Preventing Chronic Disease, 20. http://dx.doi.org/10.5888/pcd20.220209

- Glenn NM, Yashadhana A, Jaques K, Belon A, de Leeuw E, Nykiforuk CIJ, Harris P. The Generative Mechanisms of Financial Strain and Financial Well-Being: A Critical Realist Analysis of Ideology and Difference. Int J Health Policy Manage. 2023;12:6930. doi: 10.34172/IJHPM.2022.6930

- Glenn NM, Nykiforuk CIJ. The time is now for public health to lead the way on addressing financial strain in Canada. Can J Public Health. 2020;111(6):984-7. doi: 10.17269/s41997-020-00430-2.

Belon, A.P., Nykiforuk, C.N., de Leeuw, E., Harris, P., Glenn., N., Yashadhana, A., Jaques, K., Nieuwendyk, L. (2022, June 16) How to Promote Financial Wellbeing and Reduce Financial Strain? A Guidebook of Strategies and Indicators for Action at the Population Level [virtual brief oral presentation & poster]. Public Health 2022 - Canadian Public Health Association, Canada (virtual). https://www.cpha.ca/

Nykiforuk, C.N., Belon, A.P., de Leeuw, E., Harris, P., Glenn., N., Yashadhana, A., Jaques, K., Nieuwendyk, L. (2022, June 15). A Public Health Framework for Action on Financial Wellbeing and Financial Strain. [virtual brief oral presentation & poster]. Public Health 2022 - Canadian Public Health Association, Canada (virtual). https://www.cpha.ca/

Belon, A.P., Nykiforuk, C.N., de Leeuw, E., Harris, P., Glenn., N., Yashadhana, A., Jaques, K., Nieuwendyk, L. (2022, May 15-19). Introducing a Practical Guidebook of Strategies and Indicators to Support Design, Implementation, and Assessment of Effective Initiatives on Financial Wellbeing and Financial Strain [Poster]. 24th International Union for Health Promotion and Education Conference, Montreal (virtual). https://iuhpe2022.com/

Nykiforuk, C.N., Belon, A.P., de Leeuw, E., Harris, P., Glenn., N., Yashadhana, A., Jaques, K., Nieuwendyk, L. (2022, May 18). A Public Health Framework for Actions on Financial Wellbeing and Financial Strain. [Roundtable]. 24th IUHPE Conference, Montreal (virtual). https://iuhpe2022.com/

Yashadhana, A., Jaques K., Harris, P., De Leeuw, E., Belon, A., Nykiforuk, CIJ. (2021, Sept 23-24). Developing an Action-oriented Public Health Framework on Financial Well-being and Financial Strain [Long oral presentation]. Australian Public Health Conference 2021, Canberra, Australia. https://www.austph2021.com/

Canadian Institutes of Health Research (CIHR) - COVID-19 Rapid Research operating grant (#172694)

We thank all participating representatives of governments and organizations in Canada and Australia for their commitment and valuable, constructive feedback as, together, we built the Framework and Guidebook.

If you want to learn more about those resources, reach out the Centre for Healthy Communities at healthy.communities@ualberta.ca