China’s Economic Recovery in the Fourth Quarter Beats Estimates, ending 2020 with an annualized growth rate of 2.3%

Shaoyan Sun and Guofeng Wu - 5 February 2021

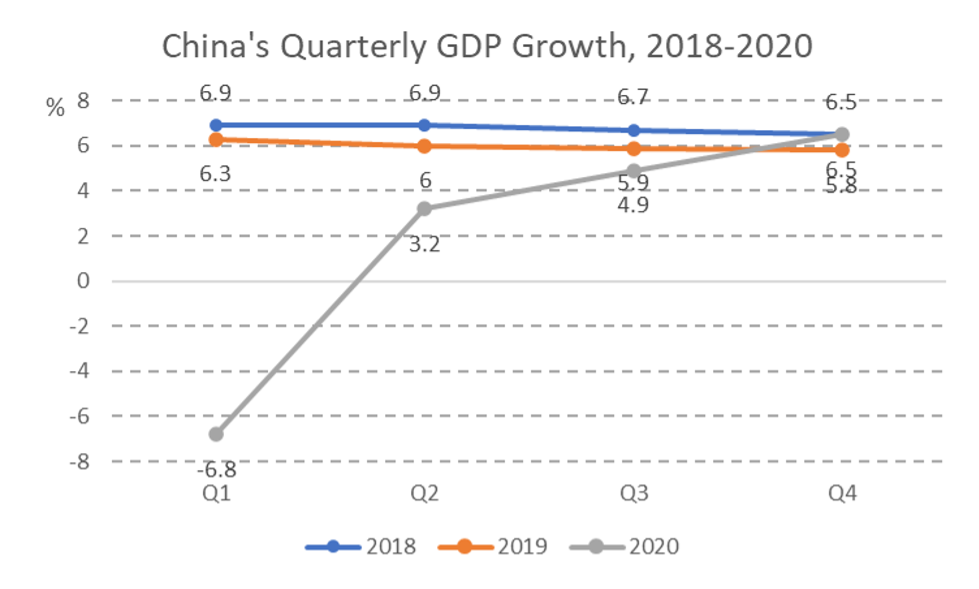

Data released by China's National Bureau of Statistics (NBS) on January 18, 2021, shows that China's economic growth accelerated over the last quarter of 2020. NBS announced that China's Gross Domestic Production (GDP) grew by 6.5% in the October-to-December period year-on-year, faster than the third quarter’s 4.9%. China’s fourth quarter growth beat analysts’ estimates pushing China’s annual GDP growth to 2.3% for 2020. China’s GDP in 2020 reached its highest level ever at 101.6 trillion yuan. China is the only major economy that achieved positive growth in 2020. This has made it likely that China will surpass the U.S. as the largest global economy sooner than previously predicted.

Figure 1.

Source: NBS, China

After a strong recovery in the third quarter following March 2020’s economic plunge, China’s fourth quarter growth returns its economy to parity with its performance in previous years. Major economic indicators, including industrial production, service, retail sales, fixed-asset investment, exports, and FDI attraction, all report rapid acceleration from the third quarter. The unemployment and inflation rates have also continued to stabilize since March 2020. Monetary and fiscal policy is shifting focus from expansion to stabilization in an effort to contain financial risks arising from the rapid credit swell. Mounting risks in the financial market, weakening overseas demand, and rising commodity prices remain significant challenges to China's economic goal in 2021.

Industrial sectors continued to accelerate in the fourth quarter and also surpassed analysts’ expectations. Industrial production, a measurement of activity in the manufacturing, mining, and utility sectors, grew by 7.1% in the last quarter and 2.8% over the entire year. The growth rate in December further accelerated to 7.3%, reaching its highest point of the year. The manufacturing sector also posted a strong growth rate of 7.6%, due in part to suppressed production capacity across the U.S. and E.U. The Chinese mining and utilities sector managed to achieve significant improvement in 2020 as well. High-tech manufacturing and innovative products, such as medical devices, electronic and communication equipment, and computer and office supplies, led the expansion of the manufacturing sector in 2020.

Figure 2.

Source: NBS, China

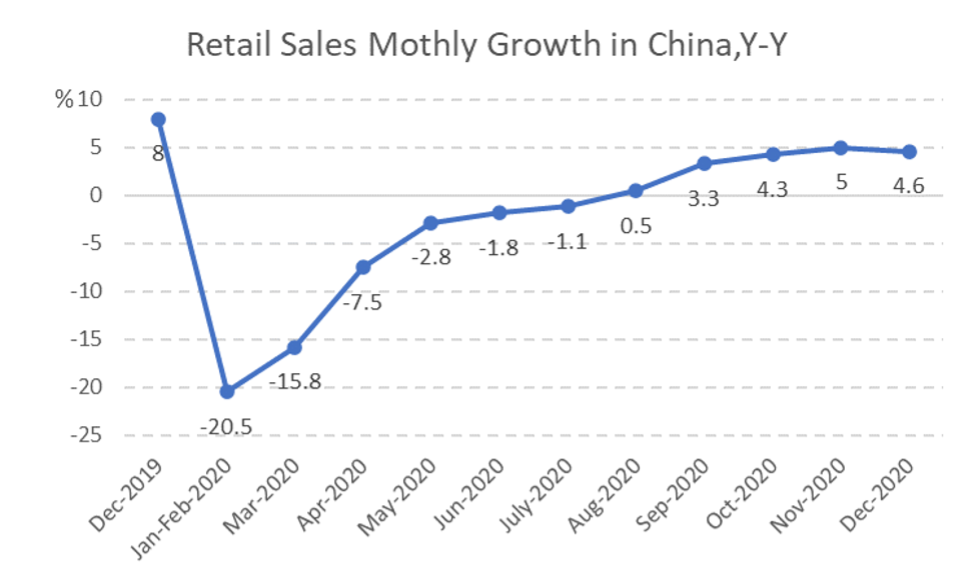

Despite lagging behind, consumer spending continued its recovery following its return to positive growth in the third quarter. Retail sales continued to pick up momentum in the last quarter, up 4.6% from a year ago and much higher than 0.9% in the third quarter. October and November retail sales grew rapidly at 4.3% and 5.0% respectively, slowing slightly in December to 4.6%. Over 2020, retail sales contracted a total of 3.9%. However, consumer spending has moved toward higher-end products such as communication and electronic equipment, cosmetics, and jewelry made with precious metals. Restaurants also returned to positive revenue growth in the fourth quarter. Hotels have been gradually recovering from the slump, although there was still a loss in revenue in Q4 2020. Lastly, traditional retailers, such as grocery and department stores, brought in more customers than in the prior three quarters.

Figure 3.

Source: NBS, China

Fixed-asset investment, a gauge of spending on infrastructure, property, machinery, and equipment marked a year-on-year increase of 2.9% in 2020. Infrastructure and real estate investment were the primary drivers of growth, increasing by 0.9% and 7.0% respectively. Residential property investment growth led the real estate sector. Investment in manufacturing dropped by 2.2% year-on-year, though the gap is narrowing as the economy recovers. Investment from the private sector increased by 1.0%, reversing the downward trend in the first three quarters. It is also worth noting that the high-tech sector attracted 10.6% more investment over 2020 than it did in 2019, driving overall investment up by 0.8%.

Figure 4

Source: NBS, China

China’s total trade volume amounted to US$ 1,358.6 billion in the fourth quarter of 2020 at a year-on-year increase of 11.4%, which was larger than the 7.5% expansion seen in the third quarter. Exports of medical supplies and equipment for working from home including laptops and tablets have been major drivers of the increase in trade. Furthermore, imports of raw materials such as crude, metal ore, and agricultural products such as grain and meat increased due to China’s economic recovery in the second half of 2020. Specifically, the year-on-year growth in trade volume was 8% in October, 13% in November and 12.9% in December. Exports drove the expansion with year-on-year growth of 10.9% in October, 20.6% in November, and 18.1% in December. The unexpected increase in exports resulted in a trade surplus of US$ 535 billion.

China’s inbound Foreign Direct Investment (IFDI) reached US$ 142.9 billion in 2020, an increase of 6.2% from 2019, making China the largest IFDI destination in 2020[1]. The largest increase in foreign investment came from the Netherlands, with a year-on-year increase of 47.6%, followed by an increase of 30.7% from the United Kingdom. Additionally, the service industry attracted IFDI totalling US$ 110.9 billion in 2020, a rise of 13.9% from 2019, and accounting for 77.7% of total IFDI. Furthermore, IFDI in high-tech industries increased year-on-year by 11.4%. Similarly, high-tech service sectors attracted 28.5% more foreign investment than 2019, including a growth of 78.8% in research and design, 52.7% in application of technological achievements, 15.1% in e-commerce, and 11.6% in information service. The fact that China’s IFDI increased in 2020 despite the pandemic indicated that foreign investors see opportunities in China’s economic recovery and growth trajectory. Moreover, the trend of increasing foreign investment in service and high-tech sectors gives credibility to China establishing itself as not only a larger but a more advanced economy, said a researcher from the Chinese Academy of International Trade and Economic Cooperation.[2]

China’s total Outbound Foreign Direct Investment (OFDI) reached US$ 132.9 billion in 2020, a year-on-year decrease of 3.3%. Non-financial OFDI reached US$110 billion, decreasing year-on-year by 0.4%, though it approached recovery by the end of 2020. China’s investment into countries along the BRI (the Belt and Road Initiative) accounted for US$ 11.8 billion and 16.2% of total OFDI. Additionally, investment across an array of sectors grew rapidly, including wholesale and retail sectors grew rapidly (a year-on-year increase of 27.8%), scientific research and technical service (18.1%), rental and business service (17.5%), and production and supply of electricity (10.3%).

The urban surveyed unemployment rate was 5.3% in October, 5.2% in November and December, which was a slight improvement compared to an average of 5.6% in the third quarter. Due to the policy that encourages rural migrant workers to work locally, more rural migrant workers were employed. At the end of 2020, the employment of rural migrant workers had recovered to 97.3% of its level at the end of 2019. Additionally, policies including expanding the enrollment of graduate students and encouraging college graduates to start their own business have effectively promoted the employment of college graduates. The unemployment rate of college graduates in December was 7.2% lower than in July. Furthermore, individuals between the ages of 25 and 59 had higher employment than average. The urban surveyed unemployment rate for individuals between 25 and 59 was 4.8% in September and 4.7% in both November and December.

The Consumer Price Index (CPI) increased by 0.5% in October, decreased year-on-year by 0.5% in November, and then increased by 0.2% in December. November’s decrease was the first fall in CPI since October 2009. This was mainly attributed to decreases in food prices, which fell by 2% year-on-year in November, after increasing by 2.2% in October. Pork prices remained the major factor driving these changes. As reported by China’s National Bureau of Statistics, the price of pork decreased year-on-year by 12.5% in November. When excluding prices of food and energy, the year-on-year growth rate of core CPI was stable, with a growth of 0.5% October and November, and 0.4% in December.

The Producer Price Index (PPI) decreased year-on-year by 2.1% in October, 1.5% in November and 0.4% in December. The rate of its contraction decreased compared to an average year-on-year decrease of 2.1 % in the third quarter. The slowing of PPI contraction in the fourth quarter can be attributed to the fall of intermediate goods’ prices. Prices of intermediate goods decreased by 2.7% year-on-year in October (0.1% less compared to the previous month), 1.8% in November (0.9% less compared to the previous month) and 0.5% in December (1.3% less compared to the previous month). The year-on-year decrease of consumer goods’ prices, on the other hand, expanded in October (0.4% more[3] to 0.5%) and November (0.3% more to 0.8%) and then contracted in December (0.4% less to 0.4%).

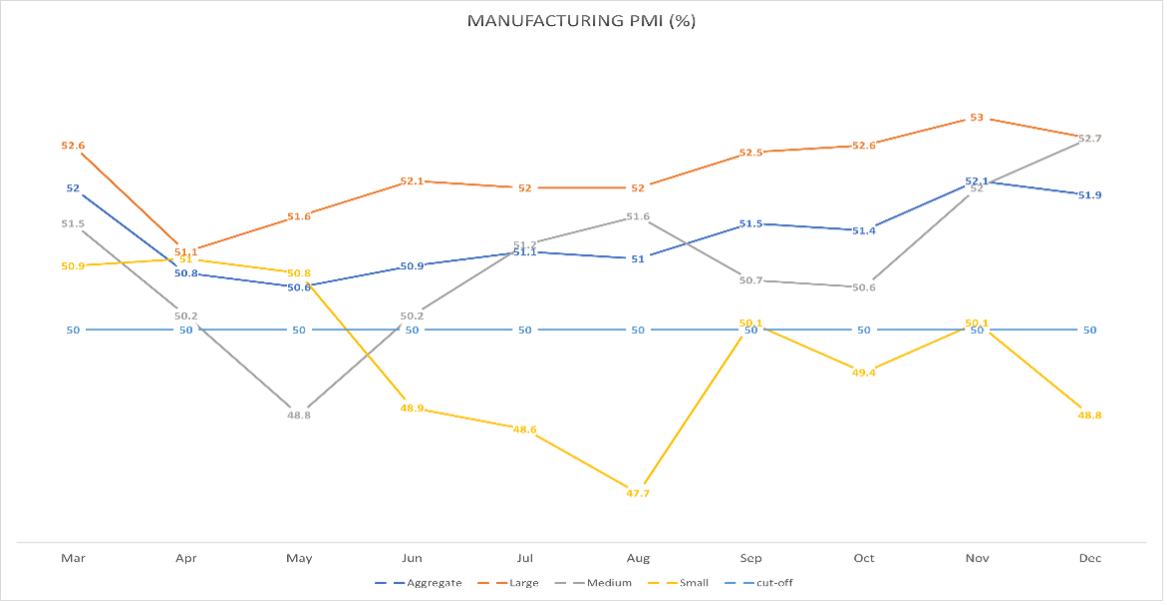

China’s comprehensive Purchasing Managers’ Index (PMI) was 55.3% in October, 55.7% in November and 55.1% in December, remaining above the cut-off point (50%)[4] since March 2020. Likewise, the manufacturing PMI was 51.4% in October, 52.1% in November, and 51.9% in December, a slight improvement compared to the third quarter in which the manufacturing PMI was 51.1% in July, 51% in August, and 51.5% in September. Despite a stable recovery in the manufacturing sector, small businesses[5] struggled relative to their larger counterparts. As indicated in Figure 5, the manufacturing PMI for small businesses was below the cut-off point in October (49.4%) and December (48.8%) and only slightly above the cut-off point in November (50.1%). This was due to both decreasing demand for products supplied by small businesses and the disproportionate increase business costs for small businesses, according to the Statistical Analyst from Chinese National Bureau of Statistics.[6] Lastly, the non-manufacturing business activity index reached 56.2% in October, 56.4% in November and 55.7% in December. Within this group the construction sector fared particularly well, attaining a business activity index score of 59.8% in October, 60.5% in November, and 60.7% in December.

Figure 5.

Source: NBS, China

Due to mounting financial risks caused by high liquidity, stable and flexible monetary policy remained the core of China’s macroeconomic agenda in the fourth quarter. The PBOC, China's central bank, declared that the market's liquidity was ample and that credit was growing at a reasonable rate. The growth of liquidity and loans remained stable. By the end of December, China's outstanding “total social financing,” a broad measurement of liquidity and credit in the economy, grew by 13.3% from a year earlier. The broad money supply, or M2, increased by 10.1% year-on-year, compared with 10.7% by the end of November and 10.5% by the end of October. Outstanding loans at the end of December were up 12.5% from last year, unchanged from the end of November. Additionally, credit creation in China's real economy appears to have slowed as a result of the government's determination to keep the debt level in check.

China’s robust recovery in 2020 points to a strong outlook for economic growth in 2021. Capital investment, especially investment in infrastructure and real estate, is a primary driver of China’s rapid economic recovery from the damage caused by the COVID pandemic. New infrastructure, high-end manufacturing, and lifestyle services are three sectors that will lead investment in 2021. Exports are another significant driver of 2020’s economic expansion, up 4% from a year ago; however, headwinds will challenge exports as the yuan continues to rise against the U.S. dollar and labour-intensive industries move out of China. Domestic consumption is also bouncing back at an accelerating rate after its fall in the first quarter. The demand-oriented policies and the rally of the transportation and travel industry poise consumption to be a growth leader for China’s economy in 2021.

China continues to eye consumption over stimulus-led investment to facilitate future economic growth as consumption’s share of contribution to GDP continues to grow in the fourth quarter. In line with the “Dural Circulation” strategy, China introduced a demand-side reform aimed at sustaining the country's long-term economic growth and social stability. Supply of goods and services will remain as a precursor to demand highlighting the need to sustain implemented supply side reforms. Improved trade and investment conditions with E.U. through the China-EU Comprehensive Agreement on Investment (CAI) may also boost China's economy in the future, particularly high-end manufacturing that will benefit from E.U. cutting-edge technology.[1] The signing of Regional Comprehensive Economic Partnership (RCEP) with Asian-Pacific nations is another milestone for China’s trade and investment by supporting China’s growing influence over free trade in the region.[2]

Despite China’s relatively strong economic performance in 2020, challenges and risks from both outside and inside China will weigh on growth in 2021. The COVID-19 pandemic could continue to disrupt global supply chains and overseas demand for Chinese goods and services. Uncertain monetary and fiscal policy under the new Biden administration in the U.S. may also undermine China’s financial stability and trade deals. In the domestic market, soaring debt also threatens China's economic growth in 2021. China’s macro leverage ratio, a gauge of the debt held by Chinese governments, households, and companies divided by GDP, jumped by about 30% in 2020 to over 270%. Credit risks may also continue into 2021. A wave of bond defaults by state-owned enterprises beginning in November points to high credit risks, however, these are unlikely to lead to systemic risks due to continuous economic growth and a high savings rate in China. As the only major economy that has achieved positive growth in 2020, analysts are generally optimistic about China’s future growth outlook. The International Monetary Fund (IMF) forecasted China’s GDP to grow by 7.8%, while the Bloomberg survey of economists optimistically predicts an expansion of 8.2% in 2021. The Chinese Academy of Social Sciences cautiously projected a growth rate of 7.8% in their Blue Paper on China’s economy, published in mid-December 2020.

[1] Global foreign direct investment fell by 42% in 2020, outlook remains weak. UNCTAD. January 24, 2021.

https://unctad.org/news/global-foreign-direct-investment-fell-42-2020-outlook-remains-weak

[2] China’s FDI reached more than 1,000 billion RMB in 2020. Economic Information Daily. January 21, 2021.

http://www.ce.cn/macro/more/202101/21/t20210121_36243837.shtml

[3] Compared to the previous month.

[4] 50% out of the total 100% of PMI is regarded as the prosperity versus depression cut-off point of the economic performance. The economy is on a growth track if PMI exceeds 50%, while otherwise, the economy is in recession.

[5] Large businesses are those with revenue more than 400 million RMB and employ more than 1000, medium businesses are those with revenue between 20 million RMB and 400 million RMB and employ between 300 and 1000, small businesses are those with revenue between 3 million RMB and 20 million RMB and employ between 20 and 300. Source: Chinese National Bureau of Statistics.

[6] China’s PMI in October 2020. National Bureau of Statistics.

http://www.stats.gov.cn/tjsj/sjjd/202010/t20201030_1797712.html

China’s PMI in November 2020. National Bureau of Statistics.

http://www.stats.gov.cn/tjsj/sjjd/202011/t20201130_1806037.html.

China’s PMI in December 2020. National Bureau of Statistics.

http://www.stats.gov.cn/tjsj/sjjd/202012/t20201231_1811925.html.

[7] Although the CAI and RCEP still need to be ratified by the members of the two agreements before they come into effect, they are still broadly considered key milestones for China’s regional and global free trade and investment.

Shaoyan Sun Postdoctoral Research Fellow

Shaoyan's current research at the China Institute specializes in Canada-China trade and economic relations, the economic impact of trade barriers on the bilateral Canada-china trade, the impact of China-Canada investment on firms in both countries.

Guofeng Wu Postdoctoral Research Fellow

Guofeng's current research at the China Institute specializes in China’s foreign trade and investment policy, the development of China’s service trade, and economic relations between Canada and China.